An out-of-pocket cost, or gap, is money you pay over and above what you get back from Medicare and your private health insurer, for either medical or hospital charges.

An out-of-pocket cost, or gap, is money you pay over and above what you get back from Medicare and your private health insurer, for either medical or hospital charges.

Here are a few common reasons why you may be left out of pocket when you’re admitted as a private patient.

Multiple specialists, multiple bills

Most hospital procedures require a number of specialists and each one can choose what they charge for their services. If any of your specialists charge more than the MBS fee (that is the set fee recommended by the government for all medical services), you’ll need to pay the difference unless your doctor participates in Medibank’s GapCover^.

Diagnostics (e.g. blood tests, X-rays, scans and ultrasounds)

If you require blood tests, ultrasounds, scans or X-rays during your hospital stay, Medibank has arrangements with major diagnostic providers to ensure you do not have an out-of-pocket cost at hospitals where they operate. For other providers, if you are charged more than the MBS fee, you will have an out-of-pocket cost.

GapCover doesn’t apply to diagnostics.

Medical devices and human tissue products (e.g. prostheses)

Medical devices and human tissue products that are surgically implanted in your body to help it function. For items listed on the government's Prescribed List of Medical Devices and Human Tissue Products (Prescribed List), we pay the minimum amount set by the government. If your item costs more than the minimum amount, you will need to pay the difference.

Likewise, if you and your surgeon select a prosthesis that’s not on the Prescribed List, you’ll need to pay the full amount on the item. To help minimise your expenses, it’s worth discussing options with your surgeon to find out if they can choose items that are on the Prescribed List.

Excess and per-day payment (or co-payment)

An excess is the amount you as a private patient pay towards your hospital admission (same-day or overnight) before your insurer pays anything. Depending on your cover, you may need to pay an excess for your stay upon admission. In Medibank’s case, the excess is only applied once per calendar year per member, and does not apply to a child, student or adult dependant on a family membership.

Much less common than an excess, a per-day payment (or co-payment) is a daily charge you may pay towards your hospital accommodation. To check if you need to pay a per-day payment, please check your Cover Summary by logging into My Medibank or the My Medibank app.

Associated hospital costs

Generally speaking, hospital services such as TV hire, telephone calls, newspapers, parking and take-home items like crutches will incur a fee. Ask the hospital about these charges before your treatment.

Pharmaceuticals

The Australian Government has a program called the Pharmaceutical Benefits Scheme (PBS) that subsidises some prescription medication. We pay towards PBS medications where:

you’re admitted to a Members’ Choice hospital for an Included service

- the pharmaceutical is directly related to the treatment of the condition for which you are admitted; and

- the pharmaceutical is not for cosmetic purposes.

We don’t pay for PBS pharmaceuticals that do not meet the above requirements, including:

- pharmaceuticals provided on discharge from hospital;

- pharmaceuticals provided at a non-Members’ Choice hospital; and

- certain high cost pharmaceuticals that aren’t on the PBS. (Please note that non-PBS pharmaceuticals include drugs that you might expect to be on the PBS, such as some used for treating cancer.)

It’s important to remember that if you choose a non-Members' Choice private hospital, you're likely to have significant out-of-pocket expenses. You can look up Members’ Choice Hospitals using our Find a provider tool.

How to minimise your out-of-pockets

There are several steps you can take to help reduce your out-of-pocket costs. Read more on how to reduce your out-of-pockets.

Informed Financial Consent

Before going to hospital it’s important to ask your doctor (or doctors) and hospital about any out of pockets you might have. This is known as Informed Financial Consent and they should provide it to you in writing. If you go to hospital because of an emergency there may not be time for Informed Financial Consent beforehand, but your doctor and hospital should still give you this information as soon as possible.

Looking for something else?

Visit our Hospital Assist homepage for a range of tools and advice to help you at every stage of your hospital journey.

Wondering about expenses for extras?

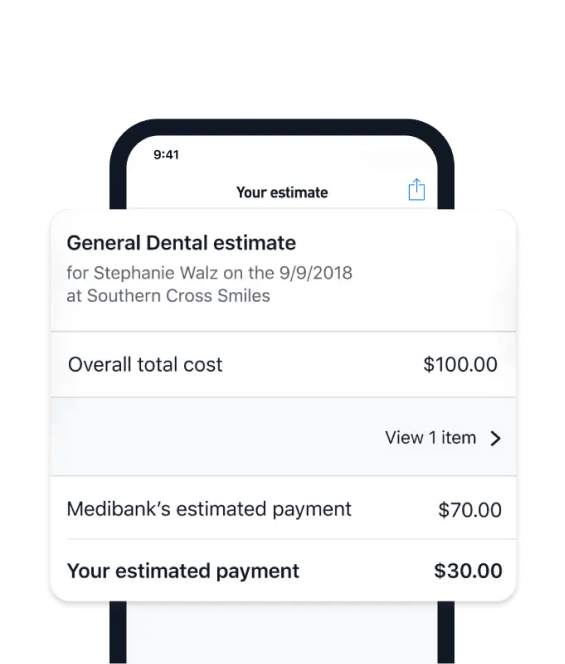

With the My Medibank app, you can now get an estimate of how much you could pay, and how much you could get back before your next visit to an extras provider. Go to “Cover” followed by "Health Insurance" section and tap on “Out of pocket estimator" to get started. Find out more about the My Medibank app here.

No Gap Joint Replacement Program

Eligible members could pay no out-of-pocket costs* for a knee or hip joint replacement.

Help the way you want it

Contact us

Call us on 134 190 to speak to a consultant. Alternatively, chat to us 24/7 online.

Self-service options

Login to MyMedibank or Download the MyMedibank App for self service options.

Find a specialist

Find a specialist or Member's choice hospital using our find a provider tool.

Things you need to know

^ GapCover is a scheme designed to help eliminate or reduce your Out Of Pocket expenses for in hospital specialists’ charges. Doctors can choose to participate on a per claim, per treatment and per patient basis. You may be treated by more than one doctor (eg. surgeon and anaesthetist) and participation is at each individual doctor’s discretion. GapCover doesn’t apply to diagnostic services, out of hospital medical services and services not included under your policy. GapCover doesn’t apply to excesses and/or co-payments. Out of pocket costs may still apply. Please refer to the Going to Hospital Brochure or contact us on 132 331 for more information.

* There may be out-of-pocket expenses associated with outpatient appointments, such as your initial visit with a participating surgeon in their consulting rooms. An excess or per day payment may still be payable, depending on the product a member has chosen and whether they are claiming under their hospital cover for the first time in a calendar year.

While we hope you find this information helpful, please note that it is general in nature. It is not health advice, and is not tailored to meet your individual health needs. You should always consult a trusted health professional before making decisions about your health care. While we have prepared the information carefully, we can’t guarantee that it is accurate, complete or up-to-date. And while we may mention goods or services provided by others, we aren’t specifically endorsing them and can’t accept responsibility for them. For these reasons we are unable to accept responsibility for any loss that may be sustained from acting on this information (subject to applicable consumer guarantees).