-

In the Australian health system, there are a few different ways in which in-hospital medical services are funded.

To begin with, the Medicare Benefit Schedule (MBS) lists all of the medical services subsidised by the Australian government through Medicare. These medical services include doctors’ services (eg. GPs and specialists), or diagnostic services (eg. blood tests, x-rays and ultrasounds provided by your pathologist and radiologist).

For each service listed in the MBS, the government has determined a set fee. Medibank pays benefits to Medibank health members towards their in-hospital medical services based on the MBS.

Doctors aren’t duty-bound to charge only the MBS fee for their services – they can choose to charge an amount above the MBS fee. This is where out-of-pocket costs can arise. But there are some scenarios where Medibank’s GapCover can help reduce your out-of-pocket medical expenses.*

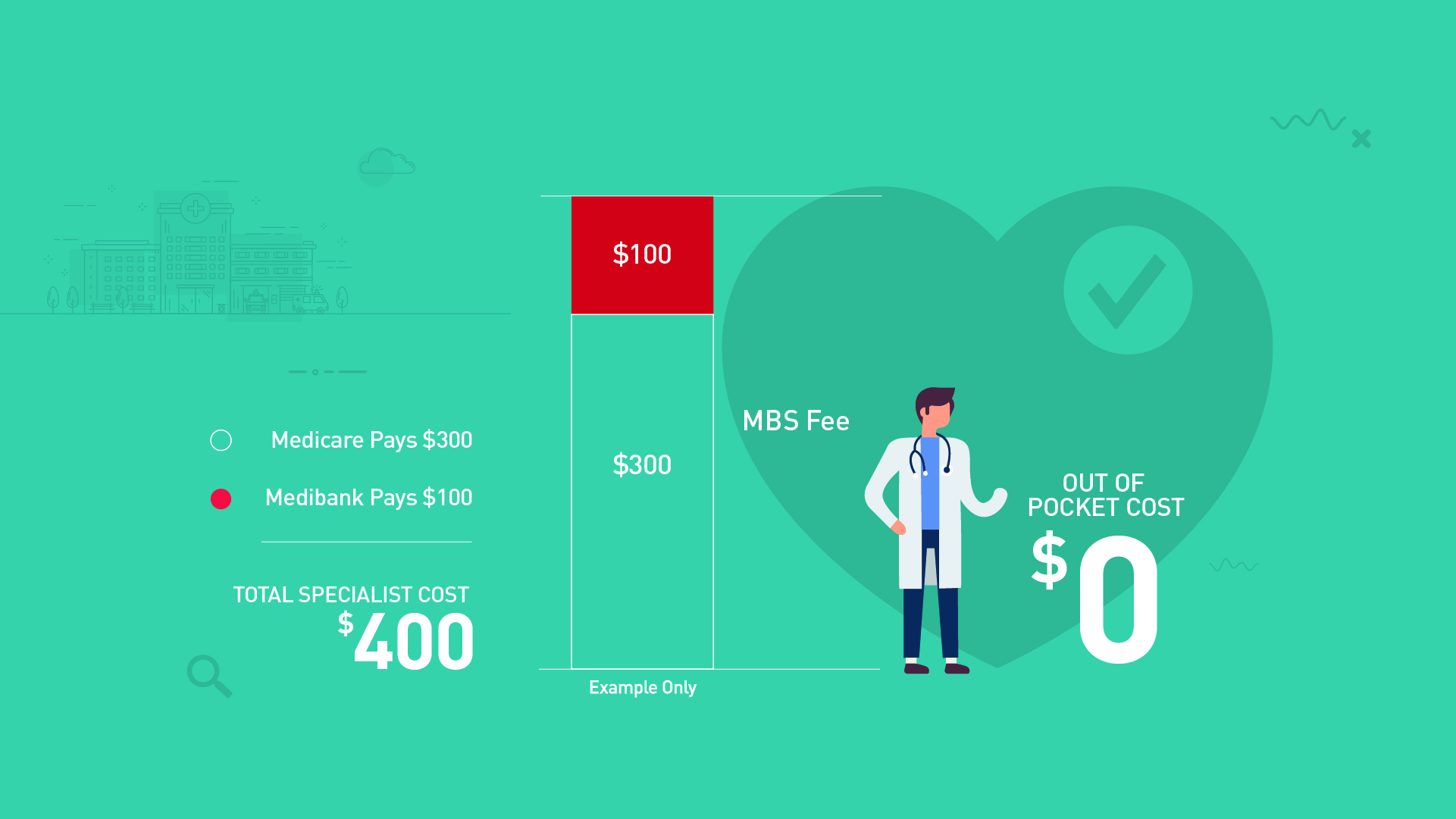

Scenario one:

If you receive in-hospital medical services for an MBS listed service (that is included in your Medibank hospital policy), and if your doctor charges no more than the MBS listed fee, then the cost will be covered by Medicare (75% of the MBS fee) and Medibank (25% of the MBS fee). This means that you won’t have an out of pocket expense for your in-hospital medical services.

How does GapCover work?

-

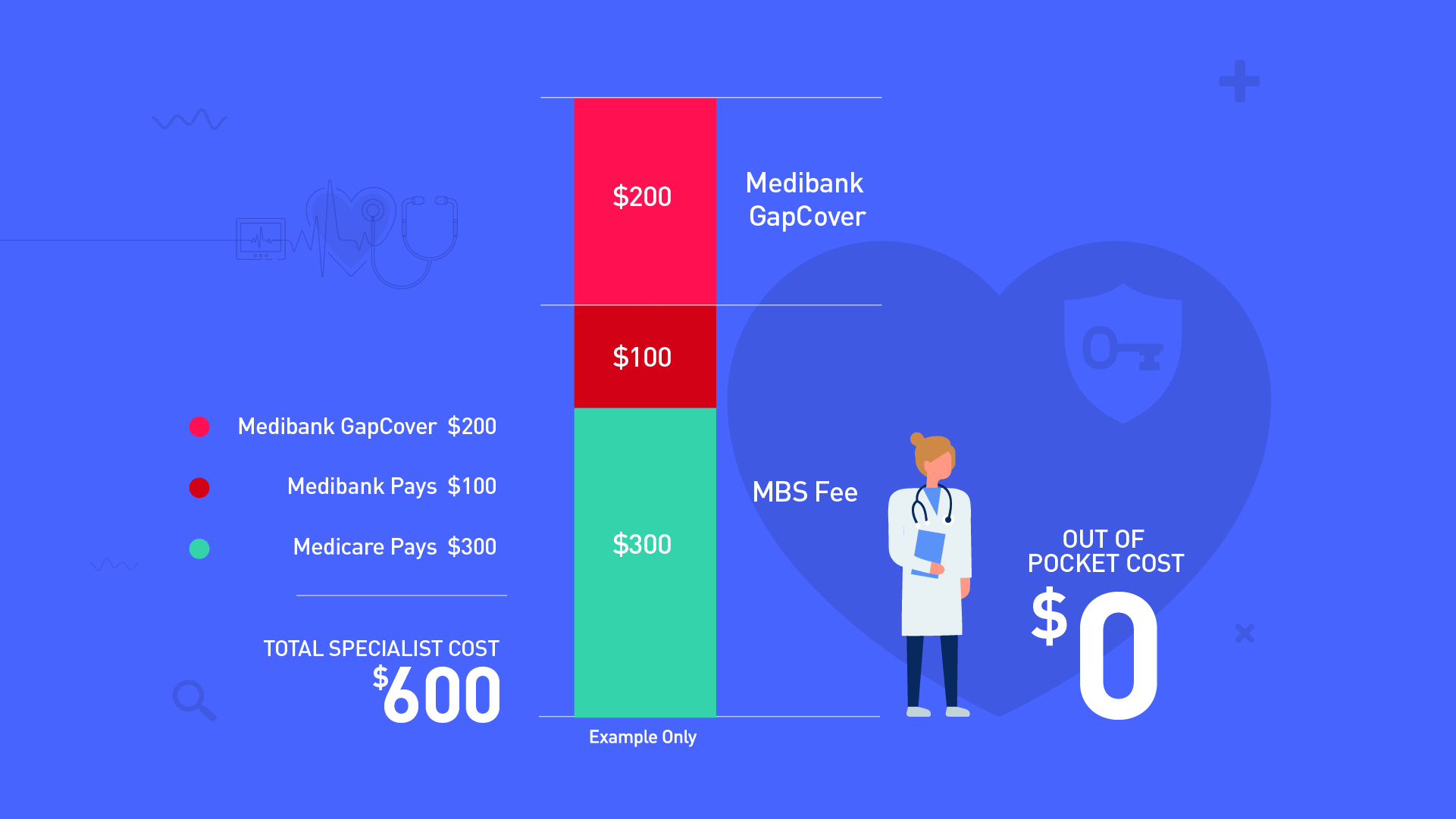

Scenario two:

If your doctor decides to charge more than the MBS fee for your in-hospital medical treatment, you will be left with an out-of-pocket expense to pay after Medicare and Medibank have paid their portions. This is commonly referred to as the ‘gap’.

The good news is that Medibank has a scheme designed to help reduce your out-of-pocket expenses for in-hospital medical treatment, aptly named ‘GapCover’. If your doctor chooses to participate in GapCover and you have a Medibank hospital policy that includes GapCover,# then Medibank may pay an additional benefit (ie. GapCover benefit) above the MBS fee.

If the GapCover benefit is sufficient to cover the whole ‘gap’ then you will not have an out of pocket expense. Please note that GapCover doesn’t cover all medical services, and doctors can choose whether or not to participate in GapCover for part, or all of your treatment.*

-

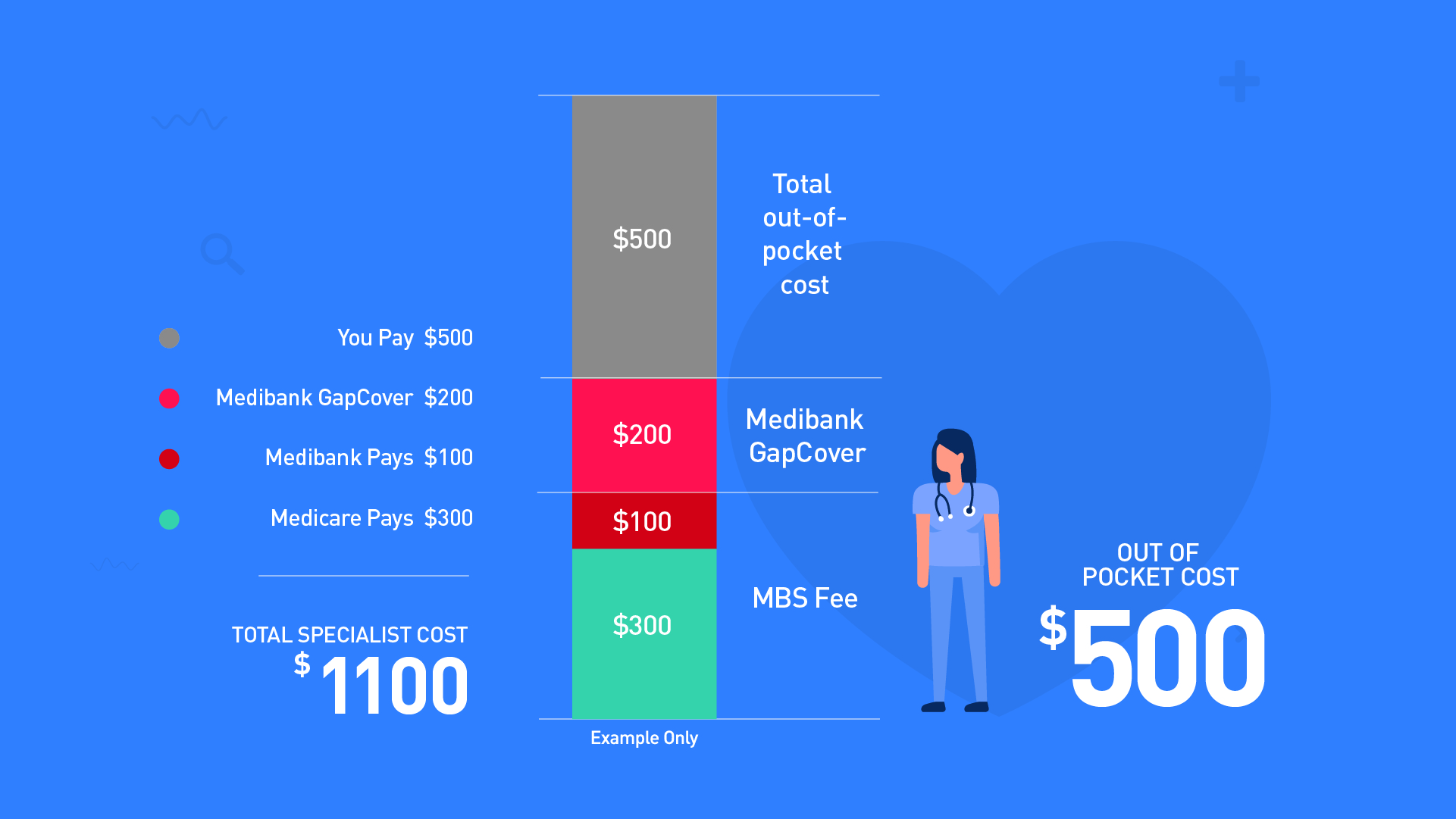

Scenario three:

If your doctor chooses to participate in GapCover but the maximum GapCover benefit is not sufficient to cover the whole gap, then you will be charged an out-of-pocket expense. Provided your total out-of-pocket cost remains within $500 then GapCover is still able to be applied to help cover part of the gap.

-

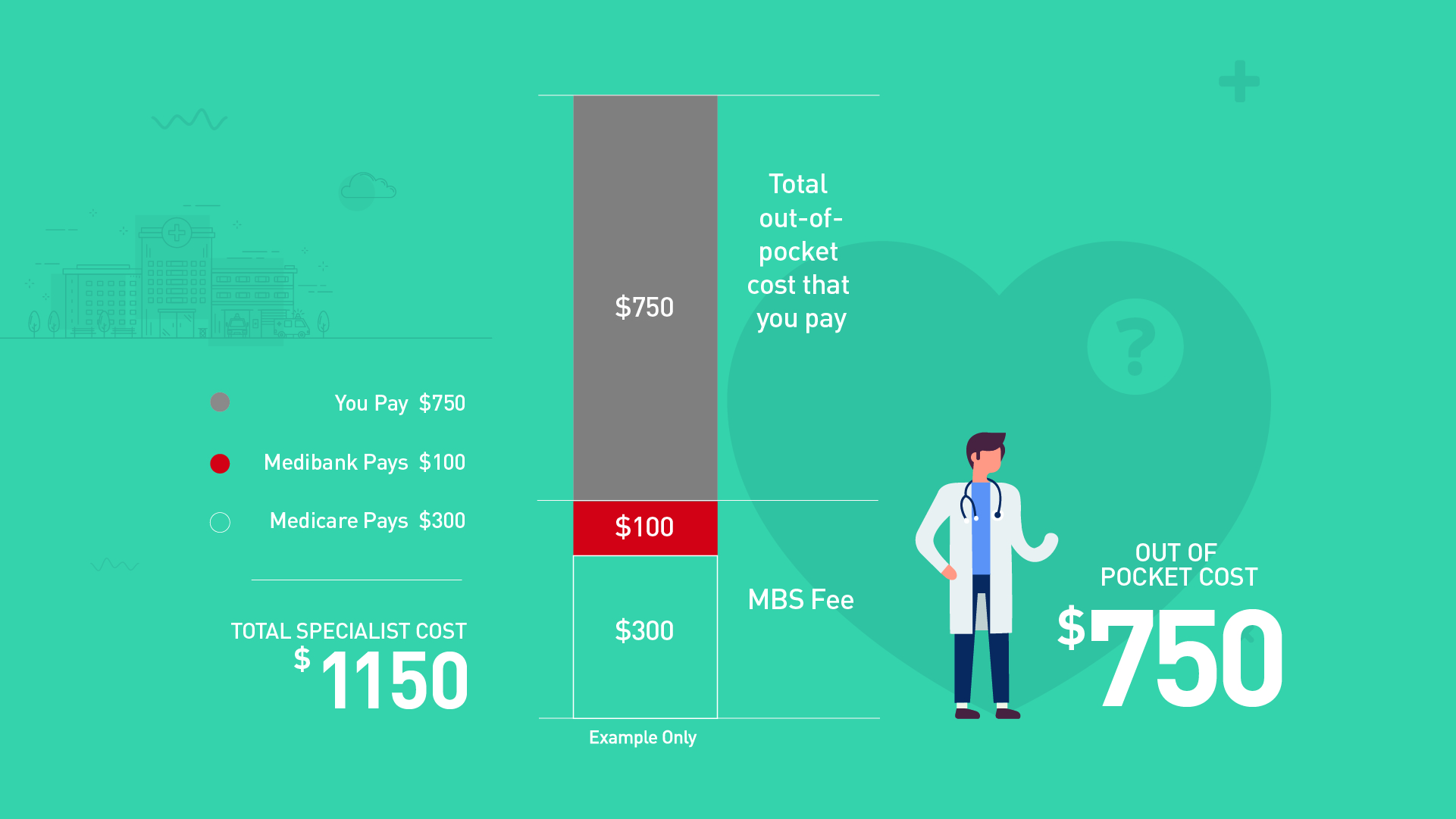

Scenario four:

If your doctor charges a ‘gap’ that results in an out-of-pocket cost of more than $500, then GapCover is not able to be applied to help cover any of the gap. This unfavourable scenario results in the highest out-of-pocket expense as you will need to pay the whole gap amount yourself.

Similarly if your doctor chooses not to participate in GapCover, then you must pay the whole gap as an out-of-pocket cost.

-

While doctors don’t have to participate in GapCover, you can see from the above scenarios that it’s always worth asking the question to help you reduce your out-of-pocket expenses.

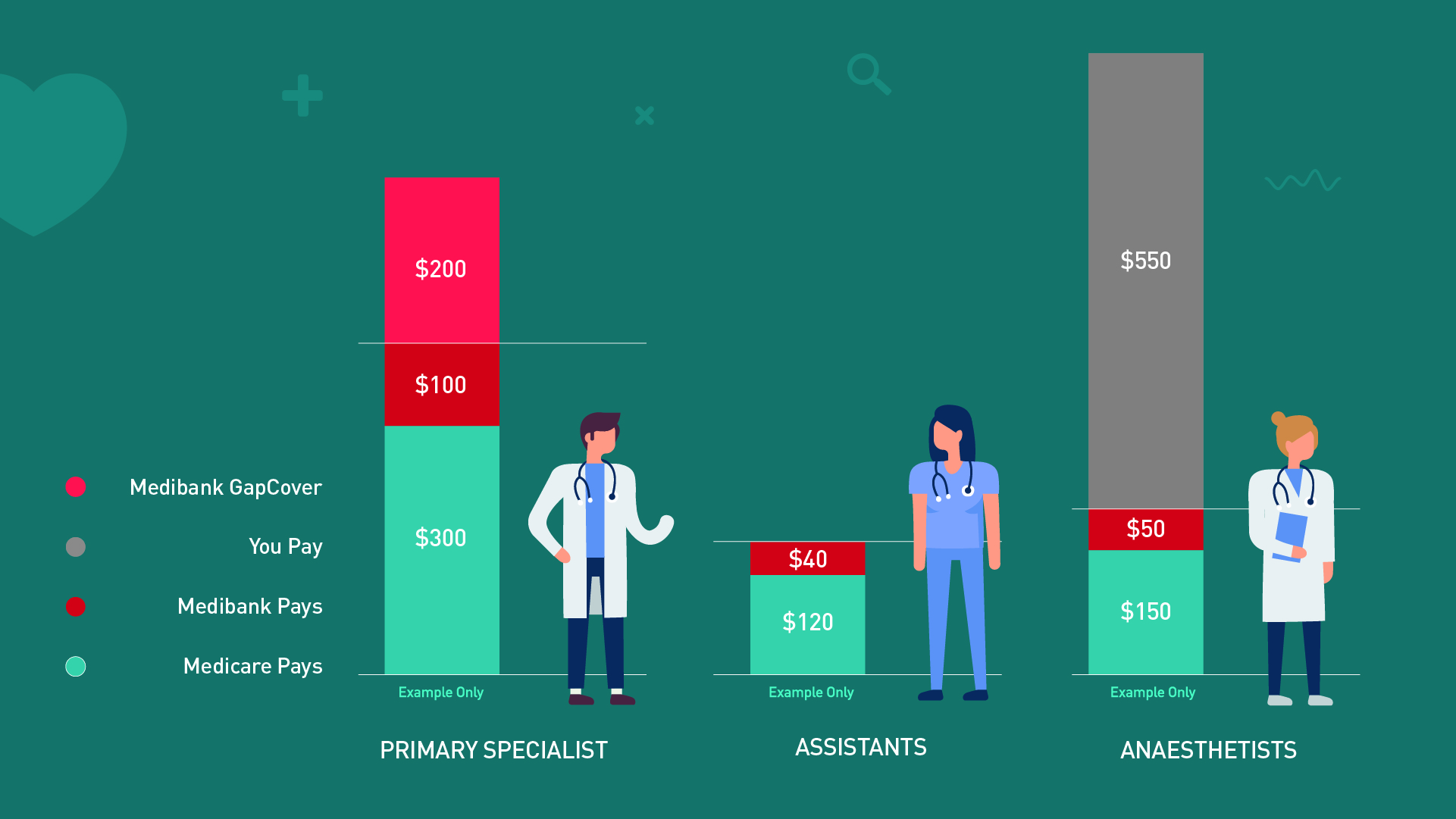

And remember, there may be several doctors involved in your procedure (eg. your primary specialist, assistants, anaesthetists, etc.) who will each be charging a fee for their service – ask each of your treating doctors for a breakdown of all the costs in writing. This is known as Informed Financial Consent.

-

By being a Medibank health member and choosing a doctor who chooses to participate in GapCover (and one who will treat you at a Medibank Members’ Choice hospital), your out-of-pocket expenses could be significantly reduced.*

It’s important to note that out-of-pocket expenses may arise for costs associated with your hospital accommodation as well.

If you are anticipating a hospital admission, be sure to read our Going to hospital brochure, or give us a call on 132 331 so we can give you the info you need to help you minimise your out-of-pocket medical expenses, and maximise your potential for achieving better health.

* GapCover doesn’t cover all medical services. GapCover also does not apply to diagnostic services including pathology and radiology services, out-of-hospital medical services, and services not included under your policy. GapCover also doesn’t apply to things such as any applicable excess payment and per-day payment. You may still have out-of-pocket costs.

# Given that participation in GapCover is optional for the specialist, then it is important to check upfront with each specialist involved if they’ll participate in GapCover for all claims as part of your treatment to help reduce your out-of-pocket expenses. Most Medibank Private Hospital covers provide benefits for medical services which are eligible for GapCover benefits. However the following hospital covers are not eligible for GapCover benefits: Basic Public Hospital Cover, Overseas Student Health Cover, Visitors Health Insurance Cover and Working Visa Health Insurance Cover. Likewise, members with Extras only cover and standalone Ambulance Cover are not eligible for GapCover benefits.

-

24/7 Medibank Nurse Support

Medibank health insurance members can chat with a registered nurse anytime of the day or night.

-

How to get more from your extras

Handy hints to help you get your money’s worth.

-

How to make the most of telehealth

Medibank offers a range of telehealth programs and services to help eligible members make the most of their hospital and extras covers.

-

Making the most of your health cover

Here are a few tips to help you get the most out of your Medibank health cover.

-

How health cover can help you manage your weight

Make your cover work for you.

-

What you need to know about the Australian healthcare system

Help navigating the Australian healthcare system.

Subscribe to receive the best from Live Better every week. Healthy recipes, exercise tips and activities, offers and promotions – everything to help you eat, move and feel better.

By clicking sign up I understand and agree to Medibank's privacy policy