Going to hospital can be stressful enough without having to deal with the uncertainties of how much it may end up costing you or your loved ones. That’s where Medibank GapCover comes in.

Out-of-pocket expenses explained

There’s a number of reasons why you may have to pay out-of-pocket costs when you go to hospital. However, one of the most common causes of out-of-pocket expenses is how much your specialist charges.

Specialists and providers are not restricted to charging the Medicare Benefits Schedule (MBS) fee (that is, the fee set by the government for each treatment) alone and may choose to charge more for a particular service. If they charge more than the MBS fee, you’ll have an out-of-pocket expense unless:

- your specialist participates in Medibank’s GapCover; and

- the service provided is eligible for GapCover.

Specialists’ fees and GapCover

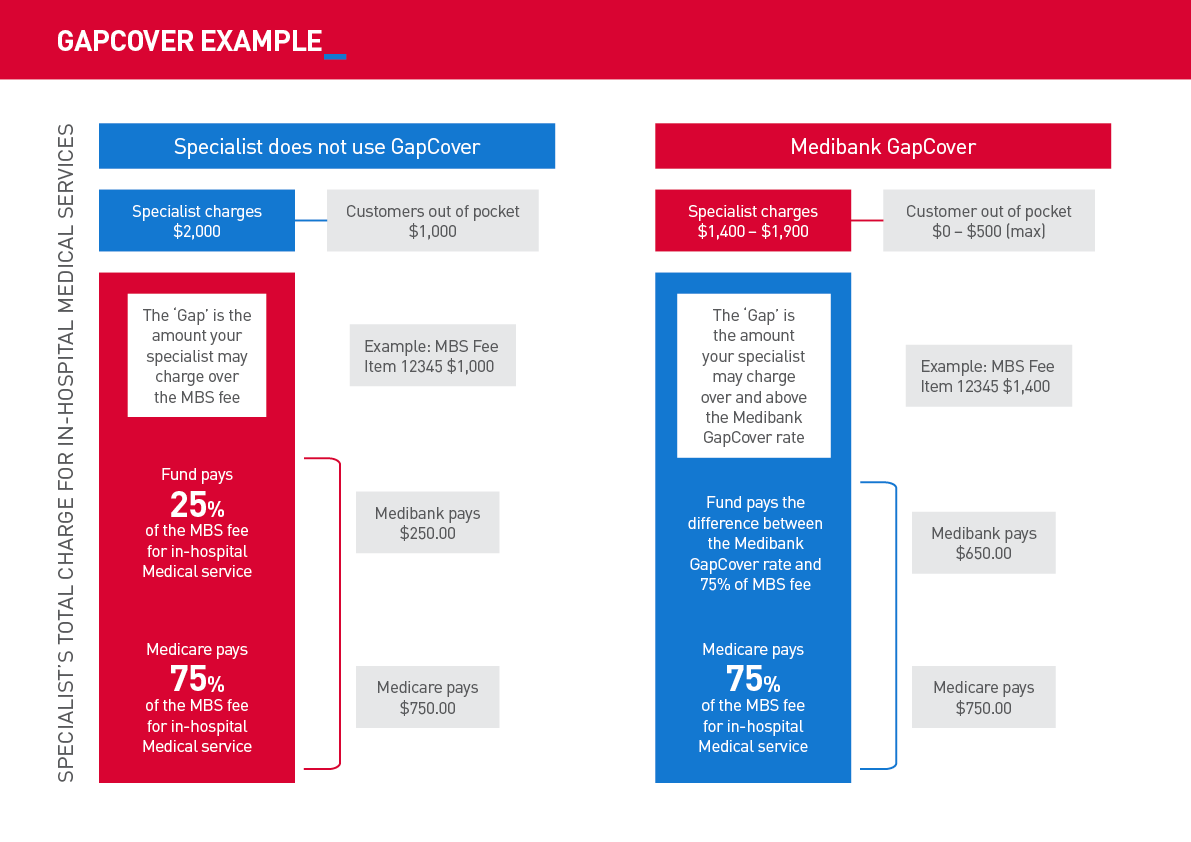

Where your specialist or specialists choose to charge more than the MBS fee, you’ll be left with an out-of-pocket expense to pay. This is commonly referred to as the ‘gap’. GapCover can help you reduce or eliminate the gap on all Medibank Hospital covers for eligible services (excluding Public Hospital covers).

If your specialist or specialists participate in GapCover for the claim forming part of your treatment, we will pay an amount higher than 25% of the MBS fee. Here's how it works:

There are two possible scenarios if your specialist participates in GapCover:

‘No Gap’

Your specialist participates in GapCover and charges you no out-of-pocket costs for the claim forming part of the treatment you receive as an inpatient.

‘Known Gap’

Your doctor participates in GapCover and charges you a limited out of pocket of no more than $500 for the claim forming part of the treatment you receive as an inpatient.

If your specialist/s chooses not to participate in Medibank’s GapCover, the amount we pay will be limited to 25% of the MBS fee. This means that where the doctor charges more than the MBS fee you’ll need to pay the gap yourself, which could result in very large out-of-pocket expenses.

It’s important to be aware that:

- It’s entirely up to your doctor whether they’ll participate in GapCover. This also applies when you’re treated by more than one doctor (eg. surgeon and anaesthetist)

- Doctors can decide to participate in GapCover on a per claim, per treatment, and per patient basis

- GapCover doesn’t apply to diagnostic services, out of hospital medical services and services not included under your policy

- GapCover doesn’t apply to excesses and/or co-payments

- Out of pocket costs may still apply. Please refer to the Member Guide for more information.

Looking for something else?

Visit our Hospital Assist homepage for a range of tools and advice to help you at every stage of your hospital journey.

No Gap Joint Replacement Program

Eligible members could pay no out-of-pocket costs* for a knee or hip joint replacement.

Help the way you want it

Contact us

Call us on 134 190 to speak to a consultant. Alternatively, chat to us 24/7 online.

Self-service options

Login to MyMedibank or Download the MyMedibank App for self service options.

Find a specialist

Find a specialist or Member's choice hospital using our find a provider tool.

Things you need to know

While we hope you find this information helpful, please note that it is general in nature. It is not health advice, and is not tailored to meet your individual health needs. You should always consult a trusted health professional before making decisions about your health care. While we have prepared the information carefully, we can’t guarantee that it is accurate, complete or up-to-date. And while we may mention goods or services provided by others, we aren’t specifically endorsing them and can’t accept responsibility for them. For these reasons we are unable to accept responsibility for any loss that may be sustained from acting on this information (subject to applicable consumer guarantees).

* There may be out-of-pocket expenses associated with outpatient appointments, such as your initial visit with a participating surgeon in their consulting rooms. An excess or per day payment may still be payable, depending on the product a member has chosen and whether they are claiming under their hospital cover for the first time in a calendar year.