= Eligible members on Medibank extras (excluding Healthy Living Extras and Gold Ultra Health) can claim a maximum of two 100% back dental check-ups per member, per year at a Members’ Choice Advantage provider (including bitewing x-rays where clinically required). For members on eligible extras, the first two check-ups do not count towards your annual limit. Members with Healthy Living Extras can get 100% back on one dental check-up each year at a Members’ Choice Advantage provider (including up to two bitewing x-rays, where clinically required) or at a Members’ Choice provider (excluding x-rays). Members with Gold Ultra Health can get 100% back on up to three dental check-ups at a Members’ Choice or Members’ Choice Advantage provider. Members’ Choice and Members’ Choice Advantage providers are not available in all areas. Two month waiting period applies. Some products may have other dental benefits, check your cover summary for details.

Choose a tailored package

Get 6 weeks free on Extras cover

Join and maintain eligible Medibank extras cover and you could get:

- 6 weeks free

- 5,000 Live Better Rewards points to redeem on rewards such as a $50 gift card

- 2&6 month waiting periods on extras

New members only.ᶲ

Benefits of Medibank Extras cover

100% back on dental check ups twice a year on eligible extras=

Here’s something to smile about – Medibank members with eligible extras cover for two months or more get 100% back on up to two dental check-ups every year, including x-rays, at any Members’ Choice Advantage dentist.=

100% back on optical on eligible extras±

When you join eligible Medibank extras you get 100% back on optical items at all recognised providers up to annual limits.±

Better value through our Members’ Choice provider network&

All Medibank members with Extras enjoy access to our Members' Choice Advantage network providers, offering capped pricing and discounts for all-round better value.

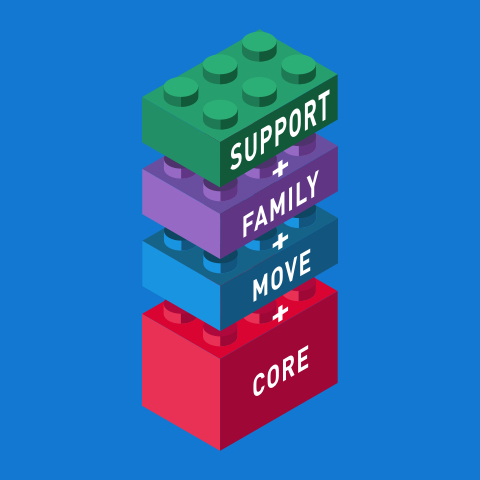

Want greater flexibility & choice with your cover?

Then how about building your own extras cover with Medibank's new My Choice Extras?

Things you should know

ᶲ For new members on new memberships who join and maintain eligible Extras cover from 14 January 2026 and who have not have held Medibank health cover in previous 60 days (unless they are dependents coming off their parent’s cover). Must quote promo code EXTRA6WEEKS and set up direct debit when joining. Eligible Extras cover means Medibank standalone Extras policies, excluding Healthy Living Extras. Offer does not apply to combined Hospital & Extras covers, Corporate covers, Hospital cover, Accident cover, Ambulance cover, Overseas Visitors Health Insurance, Overseas Students Health Cover (OSHC), Overseas Workers Health cover, ahm covers and other selected covers. Must have Australian residence. Not available with any other offer. Not available to Medibank employees. Medibank reserves the right to amend these Terms and Conditions from time to time.

6 weeks free terms: Must maintain direct debit and hold eligible cover for 42 consecutive days (6 weeks) from the policy start date to get next 6 weeks free. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Discounted amount to reflect level of eligible cover at time of discount.

2&6 month waits waived on extras terms: 2&6 month waiting periods on extras waived. Other waiting periods apply (including 12 months on some dental services). If you're switching from another fund and you've used any of your current limits (at that fund), that will count towards your annual limits with us. If you’ve reached your limits at your previous fund, you may not be able to claim straight away on extras.

Live Better rewards points terms: Must maintain direct debit and hold eligible product for 42 consecutive days after the policy start date to receive 5,000 Live Better rewards points (which may be redeemed for up to $50 in gift cards). The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank App. Policyholder will need to have registered a My Medibank account, sign up to Live Better rewards via the My Medibank App and track any Live Better rewards activity within 42 consecutive days from the policy start date. Policyholder must also maintain direct debit and continue to hold an eligible product for 42 consecutive days from the policy start date to receive the Live Better rewards points. Must be 16 years or over to register for Medibank Live Better rewards. Live Better rewards points could take up to 10 weeks from the policy start date to be loaded to the policyholder’s Live Better rewards account.

Live Better Rewards terms: Must be a Medibank member with eligible Hospital cover, Extras cover, or Hospital and Extras cover, be up-to-date with premium payments and have signed up to Live Better via the My Medibank app to redeem Rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/

± Excludes Healthy Living Extras and select products that are no longer available for sale (for more information check your cover summary or check this page). Applies to prescription glasses and select contact lenses. Some glasses lens coatings and contact lenses are excluded. To find which specific items are included or excluded, call us on 132 331. 6 month waiting period applies.

& Members' Choice providers are not available in all areas and may change without notice.