How much extra tax could you pay without hospital cover?

Nice one! Looks like you might not have to pay the Medicare Levy Surcharge.

This is a guide only. It assumes you have no MLS dependants. You should speak to a financial advisor who will be able to take into account your income and personal situation, including any changes that occur during a tax year.

Why not invest that money in your health

Medibank Basic Plus Healthy Start

This hospital cover includes a range of common services and procedures, such as:

- Accident Cover Boost+

- Unlimited Emergency Ambulance^

- Joint reconstructions

- Dental surgery

- And more...

Medibank Bronze Plus Value

Wallet-friendly hospital cover that can help you feel protected and support your active lifestyle.

- Gastrointestinal endoscopy

- Chemotherapy, radiotherapy and immunotherapy for cancer

- Gynaecology

- Bone, joint and muscle

- And more...

Medibank Bronze Plus Value

Invest a little more to get more cover

Wallet-friendly hospital cover that can help you feel protected and support your active lifestyle.

- Gastrointestinal endoscopy

- Chemotherapy, radiotherapy and immunotherapy for cancer

- Gynaecology

- Bone, joint and muscle

- And more...

Medibank Silver Plus Support

Providing cover towards a range of services including heart & vascular, rehabilitation and more.

- Broader range of services

- Heart and vascular system

- Plastic and reconstructive surgery (medically necessary)

- And more...

Waiting period and annual limits may apply.

+ For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months of the Accident occurring. Excludes Private Emergency Department Benefit, hospital bonus, claims covered by third parties and our Private Room Promise. Out-of-pocket costs may apply.

^ Waiting period applies. For ambulance attendance or transportation to a hospital where immediate medical attention is required and your condition is such that you couldn't be transported any other way. TAS and QLD have State schemes that provide ambulance services for residents of those States.

What is the Medicare Levy?

Currently, everyone chips into the Australian public healthcare system, Medicare. Most taxpayers contribute 2% of their taxable income, unless they earn under a certain amount, in which case they don’t need to pay anything at all. This is referred to as the Medicare Levy.

In addition to the Medicare Levy, some taxpayers also need to pay a Medicare Levy Surcharge (MLS), a government scheme designed to help take the burden off the public system.

When does the Medicare Levy Surcharge apply?

The Medicare Levy Surcharge applies if your annual income# is over $97,000 as a single (or $194,000 as a single parent/couple/family) and you or any of your dependants# don't hold an appropriate level of hospital cover. It starts at 1% and increases (up to 1.5%) depending on your annual income#. The family income threshold for single parents, couples and families is increased by $1,500 for each MLS dependant child after the first child.

However, if you and all your dependants# take out Medibank hospital cover and hold it for the full tax year, you may not have to pay the Medicare Levy Surcharge. Plus you can enjoy knowing that your health is in good hands.

Read more about Medicare Levy Surcharge.

For independent private health insurance advice, visit privatehealth.gov.au.

Hospital only offer - Want 6 weeks free plus up to $400 in gift cards?

Join and maintain eligible Bronze hospital cover or above and you could get 6 weeks free plus 40,000 Live Better points (couples and families) or 20,000 Live Better points (singles and single parents) to redeem on rewards like gift cards. Use promo code: HOSP6WEEKS. New members only.⚭

Get a quote Find out more

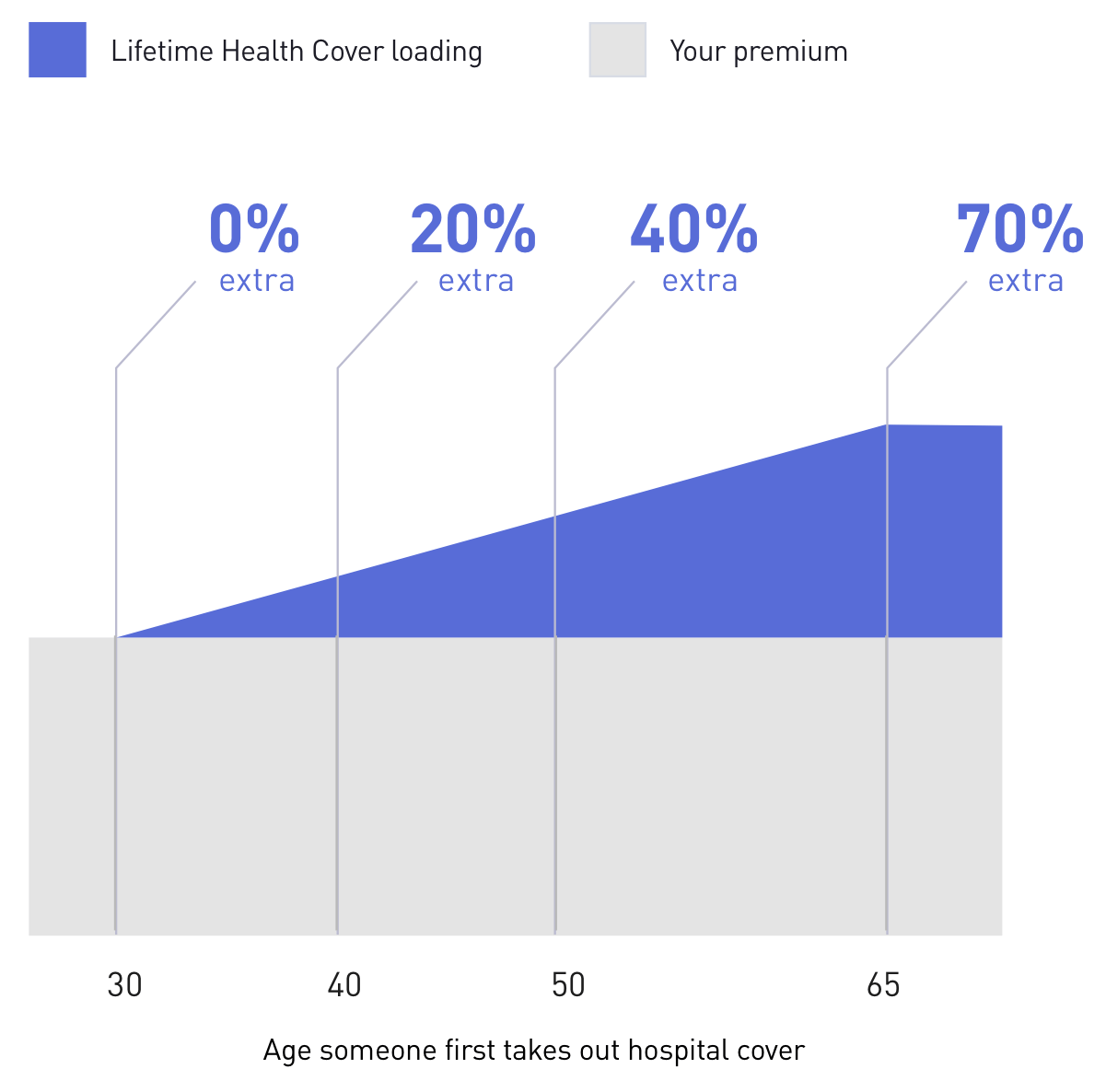

What about Lifetime Health Cover Loading (LHC)?

Once you turn 30, a 2% loading is added to your hospital cover premium for every year you’re without hospital cover. This is called the Lifetime Health Cover (LHC) loading.

You can avoid this loading by taking out and maintaining hospital cover before July 1st following your 31st birthday (this is known as your base day).

For example, if you take out hospital cover at 35, your LHC loading will be 10% of the base premium.

Read more about Lifetime Health Cover Loading

Things you should know

# 'Income’ and 'dependants' for Medicare Levy Surcharge purposes. Learn more.

⚭For new members on new memberships who join and start eligible Bronze hospital cover or above from 30 January 2025 and who have not held Medibank health cover in previous 60 days (unless they are dependents coming off their parent’s cover). Must quote promo code HOSP6WEEKS and set up direct debit when joining. Excludes Basic Hospital Cover, combined Hospital and Extras Cover, Corporate Covers, Extras only Cover, Accident Cover, Overseas Visitors Health Cover, Overseas Workers Health Cover, Overseas Students Health Cover (OSHC), Ambulance Cover, ahm covers, and other selected covers. Not available to Medibank employees. Not available with any other offer. Medibank reserves the right to amend these Terms and Conditions from time to time.

6 weeks free terms: Must maintain direct debit and hold eligible cover for 42 consecutive days from the policy start date to get next 6 weeks free. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period.

Live Better rewards points terms: Must maintain direct debit and hold eligible product for 42 consecutive days from the policy start date to receive Live Better rewards points. The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank app. Policyholder will need to have registered a My Medibank account, sign up to Live Better via the My Medibank app and track a Live Better activity within 42 consecutive days from the policy start date. Must be 16 years or over to register for Live Better. Live Better rewards points could take up to 10 weeks from the policy start date to be loaded to the policyholder’s Live Better account. Singles and single parents will receive 20,000 Live Better rewards points, and families and couples will receive 40,000 Live Better rewards points.

Live Better rewards terms: Must be a Medibank member with eligible hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Live Better via the My Medibank app to redeem rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/