Why should I consider health insurance?

We're here to help you maximise your potential by guiding you on what you need to know about health insurance while you're young. Considering hospital cover earlier in life could save you money to reinvest back into your health and give you more time to focus on what matters most - you!

Here are some things you should know:

Could you be saving on hospital cover?

The amount you could save with the Young Adult discount depends on your age when you first take out an eligible hospital cover.1 It is available to 18-29 year olds and ranges from 10% to 2%, depending on your age.2

Turning 31 and don't have hospital cover?

Lifetime Health Cover Loading is a government initiative designed to help ease the reliance on the public system. If you don't have hospital cover by 1 July following your 31st birthday and choose to take it out later in life, a loading of 2% may be added to your hospital cover premium for each year you were aged over 30 without it. Learn more about how Lifetime Health Cover Loading works.

How is Medibank different?

With countless health insurance products out there, it can be hard to know if you're making the right choice. That's why we're here to show you what sets Medibank apart in supporting you and your health.

Medibank Better Minds App

Medibank’s Better Minds app provides wellbeing checks, personalised skills training and one-on-one coaching with health professionals at no extra cost for members over the age of 18 with Hospital cover.3

24/7 Medibank Health Support

Health concerns keeping you up at night? Members with health insurance can speak to a registered nurse or mental health professional at no extra cost.4 Chat over the phone or online any time of the day or night.

Accident Cover Boost

If you have an Accident, you’ll have access to all clinical categories included in Gold level hospital cover, no matter what level of hospital cover you have, thanks to our Accident Cover Boost.5

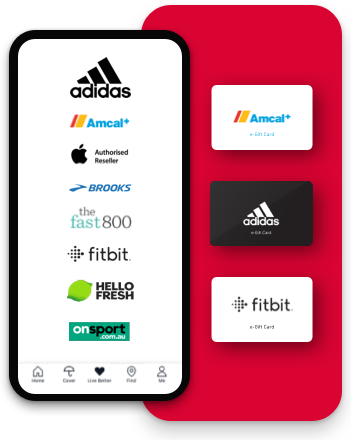

Be rewarded for healthy living

You could earn up to $400 worth of rewards every year.6

With Live Better Rewards, you can earn points by tracking healthy actions. And if you're an eligible Medibank member with hospital or extras, these points can go towards rewards from select partners such as adidas and THE ICONIC, as well as select Apple products, extras limit increases or a $200 premium payment.7

Things you should know

1 Eligible hospital cover includes residential hospital covers. Extras cover, Ambulance cover, Overseas Student Health Cover, Overseas Workers Health Cover, Overseas Visitors Health Cover and Corporate Elevate products are excluded.

2 To be eligible you'll have to have your own policy or a policy with your partner, you can't be a dependant on your parents' policy. If you are on a couple or family policy, the discount is calculated by taking an average of the discount applied to the adults on the hospital cover. So, if one person has a 10% discount and their partner has no discount, or 0%, the discount applied is 5% overall.

3 Not available for members with extras only cover, Overseas Student Health Cover or Overseas Workers or Visitors Health Cover. Some referred services may involve out-of-pocket costs.

4 Some referred services may involve out of pocket costs and waiting periods may apply.

5 For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months of the Accident occurring. Excludes Private Emergency Department Benefit, hospital bonus, claims covered by third parties and our Private Room Promise. Out-of-pocket costs may apply.

6 Medibank Live Better Challenges & Goals Earning Policy: The participant of a Medibank Live Better Challenge or Goal may not receive Live Better points or may have their already credited Live Better points reversed in accordance with the Medibank Live Better terms and conditions. To earn Live Better points, the participant needs to properly complete 100% of the eligible Challenge according to the instructions. The number of Live Better points available for Medibank Live Better Challenges and Goals is subject to change without prior notice. The maximum number of Live Better points that each Medibank Live Better member can earn from successfully completing health and wellbeing Challenges, Goals or any Onboarding action in a calendar year is 40,000 Live Better points. To the extent of any inconsistency between this Policy and the Medibank Live Better terms and conditions, the terms and conditions will take precedence.

7 Must be 16 years or over to register for Medibank Live Better rewards in the My Medibank app. Some program partners and earning activities require a person to be at least 18 years of age to be eligible to earn and/or redeem a reward. Must be a Medibank member with hospital cover, extras cover, or hospital and extras cover, and be up-to-date with premium payments. Excludes Overseas Student Health Cover (OSHC), Ambulance only cover, ahm covers and other selected covers. Live Better Management Pty Ltd, ACN 003 457 289 has entered into commercial arrangements with Medibank Live Better program partners and may receive commissions. Please choose carefully as rewards will not be amended, cancelled, exchanged or refunded due to change of mind. Points earning activities and rewards are subject to change without prior notice and may be subject to availability. Additional terms and conditions may apply to points earning activities and rewards. See full Medibank Live Better rewards terms. See full Medibank Live Better rewards terms.