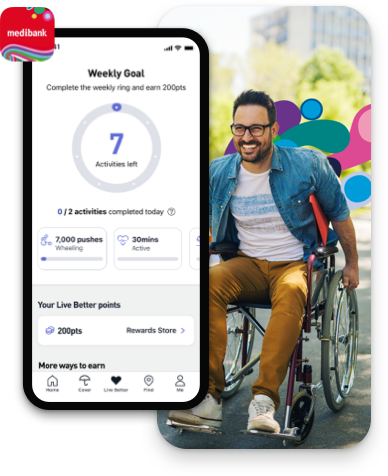

Live Better rewards

With Live Better rewards, you can earn points by tracking healthy actions. And if you're an eligible Medibank member with hospital or extras, these points can go towards rewards from select partners such as adidas as well as select Apple products, extras limit increases or a $200 premium payment.¹

Get more from your Extras cover

With Extras cover, you receive a range of benefits that reduce your out of pocket expenses when you claim on non-hospital services that aren’t normally covered by Medicare – like dental optical, physio and so much more. The types of services you will receive benefits on will depend on the extras cover you select, the waiting periods and your annual or lifetime limits.

Plus, when you visit our Members' Choice Advantage providers you can get rewarded for your dental check-ups (up to 2 per year), prescription optical purchases as well as your first podiatry, physio, remedial massage, chiro, or acupuncture consultation each year.²

100% back on dental check-ups twice a year on eligible extras3

Here’s something to smile about – Medibank members with eligible extras cover for two months or more get 100% back on up to two dental check-ups every year, including x-rays, at any Members’ Choice Advantage dentist.³

You can earn 1,000 Live Better rewards points for each dental check-up included in your cover.2

100% back on optical on eligible extras4

At Medibank we think you deserve to see the world clearly. That’s why when you join eligible Medibank extras you get 100% back on optical items at all recognised providers up to annual limits.⁴

Earn 5 Live Better rewards points for every dollar you spend on prescription items from our Members’ Choice Advantage optical provider Specsavers.²

One of Australia's largest provider networks

With over 3700 provider locations, our Members’ Choice network generally offer capped fees or discounts to help reduce out-of-pocket expenses across dental, optical, physiotherapy and more.⁵

Earn 500 Live Better points for your first annual consultation at one of our podiatry, chiropractic, acupuncture, physiotherapy or remedial massage Members' Choice Advantage providers when you hold eligible extras cover.²

Getting Hospital Cover

Medibank is a leading private health insurer, with more than 45 years of experience delivering better health to Australians.⁶

Getting hospital cover allows you to be treated in hospital as a private patient. The type of hospital services you are eligible to receive benefits for depends on whether you choose basic, bronze, silver or gold tiers. As a Medibank Hospital member, your cover will also include all of the below benefits - at no extra cost.

24/7 Medibank nurse + mental health support

Health concerns keeping you up at night? You can speak to a registered nurse or mental health professional over the phone at any time of the day or night.⁷

Accident cover boost

If you have an Accident and hold Medibank Hospital cover, you’ll get the benefits of our Gold level hospital cover, no matter what level of hospital cover you have, thanks to our Accidental Injury Benefit.⁸

Unlimited emergency ambulance

No matter which Hospital or Extras policy you choose, you'll have the peace of mind that comes from knowing that your cover includes unlimited emergency ambulance.⁹

Hospital & Extras offer - Want 6 weeks free plus up to $500 in gift cards?

Join and maintain eligible Bronze hospital and extras cover or above and you could get 6 weeks free plus 50,000 Live Better points (couples and families) or 25,000 Live Better points (singles and single parents) to redeem on rewards like gift cards. We'll also waive 2&6 month waiting periods on extras. Use promo code: 6WEEKSPLUS. New members only.€

Get a quote Find out more

Commonly asked questions

¹ Must be 16 years or over to register for Medibank Live Better rewards. Some program partners and earning activities require a person to be at least 18 years of age to be eligible to earn and/or redeem a reward. Must be a Medibank member with hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better rewards with My Medibank to earn Live Better rewards points for eligible purchases and redeem rewards. Rewards are subject to change without prior notice and are subject to availability. Excludes Overseas Student Health Cover (OSHC), Ambulance only cover, ahm covers and other selected covers. Live Better Management Pty Ltd, ACN 003 457 289 has entered into commercial arrangements with Medibank Live Better rewards program partners and may receive commissions. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. See full Medibank Live Better terms.

² Members’ Choice Advantage dentist: Maximum 1,000 points per member per calendar year for Healthy Living Extras. Maximum 2,000 points per member per calendar year for all other extras. Award of Live Better rewards points is subject to the approval of a claim for the health service. Waiting periods may apply. Not available in all areas. Points will be credited to a members' account only when the member registers as a Live Better rewards member within 6 months from the date of the receiving the health service, subject to the Medibank Live Better rewards terms. Must be a Medibank member with extras cover (excludes ambulance only cover), hospital cover or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better with the My Medibank app to redeem rewards. See full Medibank Live Better terms.

Specsavers: Points cannot be earned on the cost of any services (including eye tests), on purchases paid for with a Specsavers gift card or on non-prescription goods such as non-prescription sunglasses, safety glasses, protective glasses or precision tinted lenses. All optical items offered are subject to availability and are subject to Specsavers Terms of Service and Returns & Warranty policies. For in-store purchases, you must use your Medibank membership card through HICAPS at the time of purchase to earn Live Better rewards points. This applies even if you have hospital only cover or have already reached your annual optical extras limit. If you have extras cover and any annual optical extras limit remaining, you will also be submitting a claim for benefits. For online purchases at https://www.specsavers.com.au/, you must submit an extras claim for prescription optical goods to earn Live Better rewards points. Members with hospital only cover, or Healthy Living Extras cover cannot earn points for online purchases. Points earned will be displayed in your Live Better rewards account within 5 business days, or once you have signed up to Medibank Live Better rewards with the My Medibank app within 6 months, from the date of your in-store purchase or making an extras claim for online purchases. A maximum of 10,000 Live Better rewards points can be earned per transaction. This offer may be withdrawn or changed at any time. Live Better rewards points earned from claims for children under 18 years of age will go to the policy holder’s account. A maximum of 10,000 Live Better rewards points can be earned per transaction. This offer may be withdrawn or changed at any time.

Members Choice Advantage podiatry, physio, remedial massage, chiro, or acupuncture: Member will be awarded 500 points for their first eligible consultation each calendar year at one of the following services: physiotherapy, chiropractic, remedial massage, acupuncture or podiatry. 500 points awarded per member per calendar year for a first eligible consultation. Service must be completed by a Members' Choice Advantage provider. Must be a Medibank member with eligible extras cover, or eligible hospital and extras cover. Member must be up-to-date with premium payments. Award of points is subject to the approval of a claim for the health service. Waiting periods and annual limits may apply. Member must have already signed up to Medibank Live Better or register as a Live Better Member within 6 months from the date of receiving the eligible health service to be awarded points, subject to Medibank Live Better terms. Live Better Points earned from claims for children under 18 years of age will go to the policy holder’s Live Better account. See full Medibank Live Better terms. Excludes Overseas Student Health Cover, Ambulance Only cover, ahm covers and other selected covers. Medibank's agreements with Members' Choice Advantage providers are subject to change. Not available in all areas.

³ Eligible members on Medibank extras (excluding Healthy Living Extras and Gold Ultra Health) can claim a maximum of two 100% back dental check-ups per member, per year at a Members’ Choice Advantage provider (including bitewing x-rays where clinically required). For members on eligible extras, the first two check-ups do not count towards your annual limit. Members with Healthy Living Extras can get 100% back on one dental check-up each year at a Members’ Choice Advantage provider (including up to two bitewing x-rays, where clinically required) or at a Members’ Choice provider (excluding x-rays). Members with Gold Ultra Health can get 100% back on up to three dental check-ups at a Members’ Choice or Members’ Choice Advantage provider. Members’ Choice and Members’ Choice Advantage providers are not available in all areas. Two month waiting period applies. Some products may have other dental benefits, check your cover summary for details.

⁴ Excludes Healthy Living Extras and select products that are no longer available for sale (for more information check your cover summary or check this page). Applies to prescription glasses and select contact lenses. Some glasses lens coatings and contact lenses are excluded. To find which specific items are included or excluded, call us on 132 331. 6 month waiting period applies.

⁵ Members' Choice not available in all areas.

⁶ Based on the number of policies set out in APRA’s Operations of Private Health Insurers Annual Report 2021 for Medibank Private Limited.

⁷ OSHC members should call the Student Health and Support Line on 1800 887 283.

⁸ For Accidents that occur in Australia after your hospital cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months, of the Accident occurring. Excludes claims covered by third parties and our Private Room Promise. Out of pockets may apply.

⁹ Waiting periods apply. For ambulance attendance or transportation to a hospital where immediate professional attention is required and your medical condition is such that you couldn't be transported any other way. Tasmania and Queensland have state schemes to cover ambulance services for residents of those states.

^ You need to join Medibank within 2 months of leaving your old fund, or waiting periods apply again. Also, benefits that have been paid under your previous cover will be taken into account in determining the extras benefits payable under your Medibank cover.

€ For new members on new memberships who join and start eligible combined Bronze hospital and extras cover or above and who have not held Medibank health cover in previous 60 days (unless they are dependents coming off their parent’s cover). Must quote promo code ‘6WEEKSPLUS’ and set up direct debit when joining. Excludes Hospital only cover, Extras only cover, Basic covers, Corporate covers, Accident Cover, Ambulance Cover, Overseas Visitors Cover (OVC), Overseas Students Health Cover (OSHC), Overseas Workers Health cover, Travel Insurance, Pet Insurance, Funeral Insurance, Life Insurance & Income Protection, ahm covers and all corporate covers. Not available with any other offer. Medibank may end this offer or amend these offer terms and conditions at any time without notice. Medibank employees are not eligible for this offer.

6 weeks free terms: Must maintain direct debit and hold eligible cover for 42 consecutive days from the policy start date to get next 6 weeks free. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period.

2&6 month waits waived on extras terms: 2&6 month waiting periods on extras waived. Other waiting periods apply (including 12 months on some dental services). If you're switching from another fund and you’ve used any of your current limits (at that fund), that will count towards your annual limits with us. If you've reached your limits at your previous fund you may not be able to claim straight away on extras.

Live Better points terms: Must maintain direct debit and hold eligible product for 42 consecutive days from the policy start date to receive Live Better points. The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank App. Policyholder will need to have registered a My Medibank account, sign up to Live Better via the My Medibank App and track any Live Better activity within 42 consecutive days from the policy start date. Policyholder must also maintain direct debit and continue to hold an eligible product for 42 consecutive days from the policy start date to receive the Live Better Points. Must be 18 years or over and have a valid Australian residential address to register for Medibank Live Better. Live Better points could take up to 10 weeks from the policy start date to be loaded to the policyholder’s Live Better account. Singles and single parents will receive 25,000 Live Better points, and families and couples will receive 50,000 Live Better points.

Live Better rewards terms: Must be a Medibank member with eligible hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better via the ‘My Medibank’ app to redeem rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/