-

≈ Must be 16 years or over to register for Medibank Live Better rewards in the My Medibank app. Some program partners and earning activities require a person to be at least 18 years of age to be eligible to earn and/or redeem a reward. Must be a Medibank member with hospital cover, extras cover, or hospital and extras cover, and be up-to-date with premium payments. Excludes Overseas Student Health Cover (OSHC), Ambulance only cover, ahm covers and other selected covers. Live Better Management Pty Ltd, ACN 003 457 289 has entered into commercial arrangements with Medibank Live Better program partners and may receive commissions. Please choose carefully as rewards will not be amended, cancelled, exchanged or refunded due to change of mind. Points earning activities and rewards are subject to change without prior notice and may be subject to availability. Additional terms and conditions may apply to points earning activities and rewards. See full Medibank Live Better rewards terms.

Overseas Worker offer - Want 8 weeks free?*

Join eligible Medibank Overseas Workers Cover by 30 September 2025, sign up to direct debit and maintain your policy for the first 42 consecutive days and you could get 8 weeks free* T&Cs apply.

Use promo code: WORKER8

Working after graduation?

Medibank Worker Cover meets the health insurance requirements of working and graduate visas 482, 485, 408, 407, 403 and more.

And if you have an accident or get sick while you’re here, your cover is there to help with unexpected costs of medical treatment.

Why stay with Medibank ?

We’re proud to be trusted by 4 million members - including over 300,000 overseas members.

Trusted health partner

Medibank is an Australian leading health insurer with over 4.1 million members and almost 50 years experience in private health insurance.

Accident cover boost

Medibank members with hospital cover get the benefits of Gold level cover no matter what level of hospital cover you have, thanks to our Accident Injury Benefit.1

Protect against the unexpected

No matter which Medibank Overseas Visitors Cover you choose, your cover includes unlimited emergency ambulance Australia-wide. 2

24/7 Medibank Nurse Support & 24/7 Medibank Mental Health Support

Need support? Medibank health insurance members can speak to a registered nurse or mental health professional at no extra cost3. Chat online or call 1800 644 325 to discuss any health questions or concerns 24 hours a day, 7 days a week.

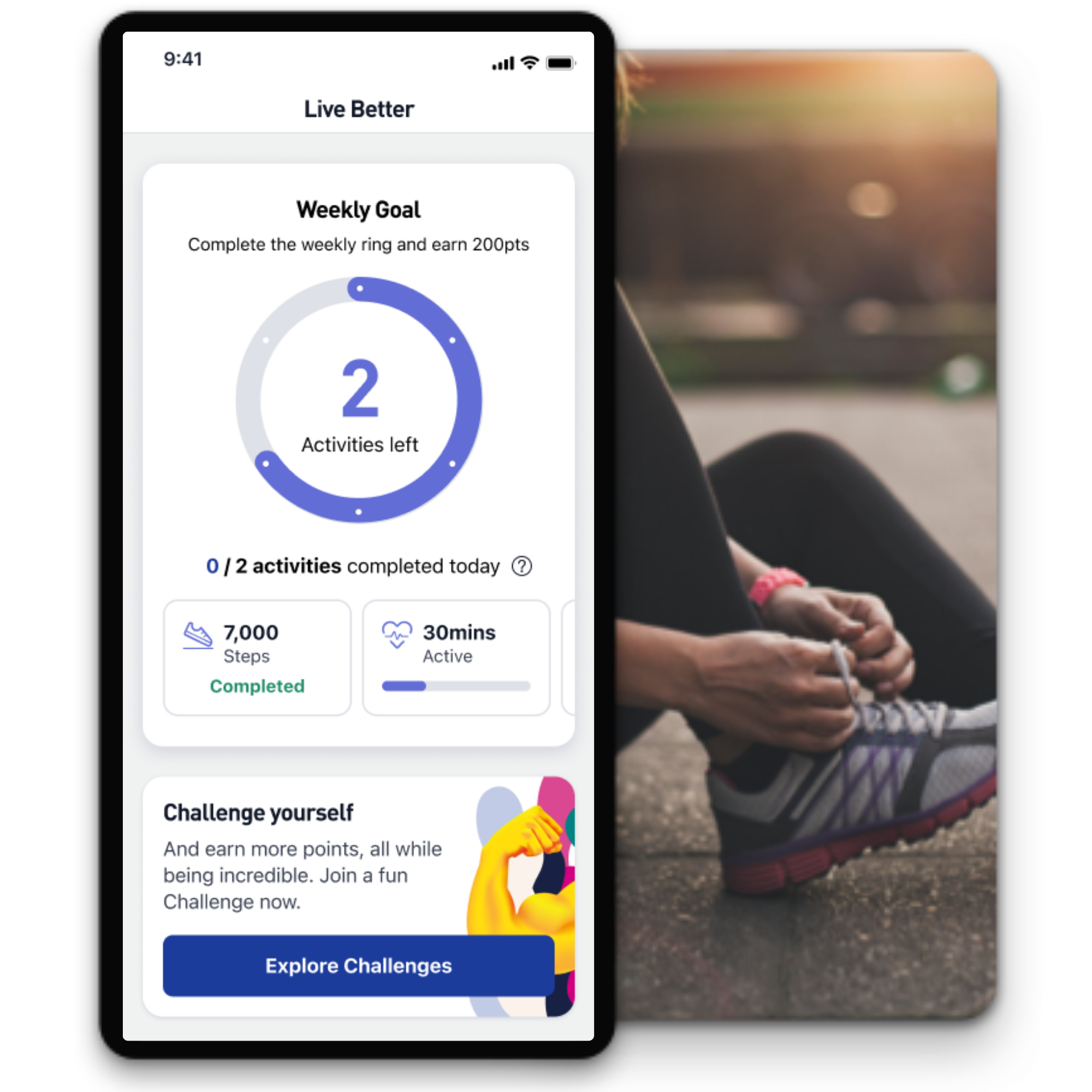

Live Better rewards

When you track any activity in the My Medibank App you could earn up to $400 worth of value in rewards every year from our range of partner brands including THE ICONIC, Apple and adidas or discounts on premium payments.≈ Experience fun ways to eat, move and feel better and earn Live Better points when you complete the Weekly Goal or monthly Challenges to redeem on rewards.

Register for Live Better rewards in the My Medibank app.

Go further with Medibank.

If you're on the lookout for value and a price that may surprise you, talk to us about finding Overseas Workers health cover that's right for you.

Use promo code: 'WORKERS1'

Things you should know

*Offer commences 1 April 2025. For current Medibank OSHC Essentials & ahm OSHC members whose OSHC policy expires from 1 April 2025. Must join and start eligible Medibank Overseas Workers Health covers from 9 April 2025. Must quote promo code ‘WORKERS1’ when joining. Member must sign up to direct debit.

Eligible Medibank Overseas Workers Health covers include the following covers only:

- Overseas Workers Base Hospital.

- Overseas Workers Standard Hospital and Medical.

- Overseas Workers Advanced Hospital and Medical Cover.

- Overseas Workers Premium Hospital, Medical and Extras.

Excludes Overseas Visitors Health Cover, all corporate covers, all residential hospital and extras covers, Overseas Students Health Cover Essentials and ahm OSHC, Ambulance Cover, ahm covers, and other selected covers. Not available if the Policy Holder has already taken up this offer. Not available to Medibank employees.

Not available with any other offer except the Overseas Extras offer). Member take up of the offer is deemed acceptance of these Terms and Conditions. Medibank reserves the right to amend these Terms and Conditions without notice from time to time.

1 month free terms: Must keep policy premium payments up-to-date and hold eligible cover for 30 consecutive days from the policy start date to get the next month free. If the member changes to an ineligible cover during this period, or they terminate or suspend their cover, 1 month free will not be issued.

~ Some referred services may involve out of pocket costs and waiting periods may apply.

+ For ambulance attendance and transportation to a hospital where immediate professional attention is required and your medical condition is such that you couldn't be transported any other way.

Liver Better points terms: Live Better rewards members could earn up to 40,000 Live Better rewards points each calendar year for successfully completing select Live Better rewards points-earning activities. These activities include, but are not limited to, health and wellbeing challenges, the Weekly Goal, onboarding actions, partner activity earn and the daily auto-tracking bonus. This does not include points earned by shopping with Live Better rewards partners or visiting Members' Choice Advantage providers. 40,000 Live Better points could be redeemed for up to $400 worth of rewards from the Live Better rewards store.

Medibank Live Better Challenges & Goals Earning Policy: The participant of a Medibank Live Better Challenge or Goal may not receive Live Better points or may have their already credited Live Better points reversed in accordance with the Medibank Live Better terms and conditions. To earn Live Better points, the participant needs to complete 100% of the eligible Challenge according to the instructions. The number of Live Better points available for Medibank Live Better Challenges and Goals is subject to change without prior notice. To the extent of any inconsistency between this Policy and the Medibank Live Better rewards terms and conditions, the terms and conditions will take precedence.