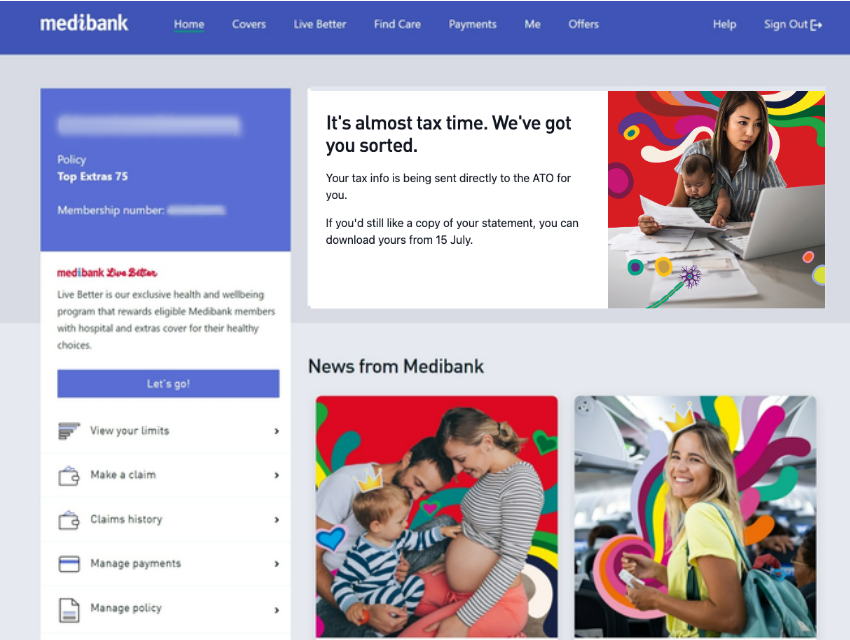

Private health insurance rebate details will automatically be uploaded to the Australian Taxation Office.

If you do your tax return online or have an accountant, you don't need a copy of your tax statement because your tax info is sent directly to the ATO for you on July 1.

It can generally take some time for the ATO to prefill the information in their system. If your information isn't appearing in myTax by 20 July please contact the Australian Taxation Office on 132 861 or visit ato.gov.au.

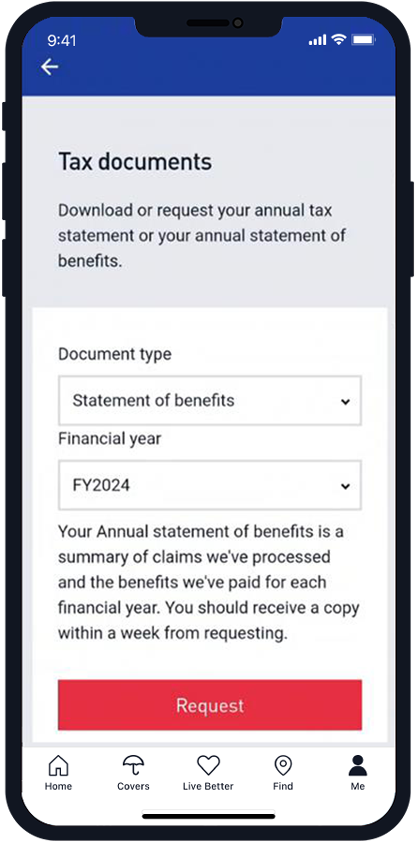

If you do a paper tax return, or would still like to view your statement, you can download up to the last three years of statements securely in My Medibank from 15 July. For instructions see below.

If you are unsure whether you need your tax statement to complete your tax return, for 1 July 2024 to 30 June 2025, please speak with your accountant or contact the Australian Taxation Office on 132 861 or visit ato.gov.au.

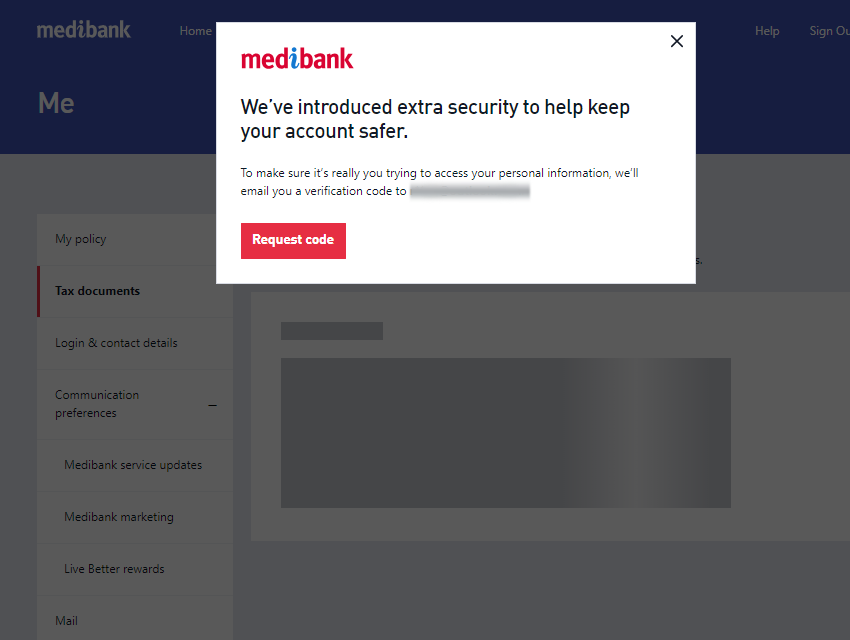

Accessing your tax statement

View and download up to the last three years your statement online

If you don't have a My Medibank web login, you can register here.

For help accessing My Medibank and troubleshooting tips, view the step-by-step guides here.

To make tax time as simple and straightforward as possible, we’ve put together a “how to read guide” that shows you where all the information goes on your tax return. Download guide.

How to view and download your statement on the web

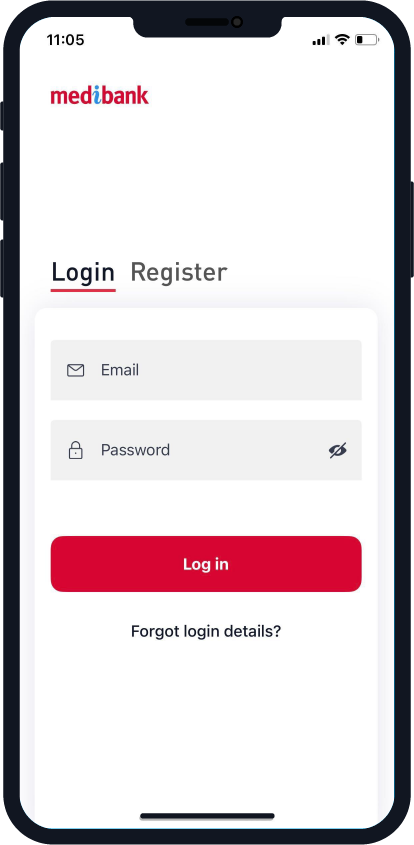

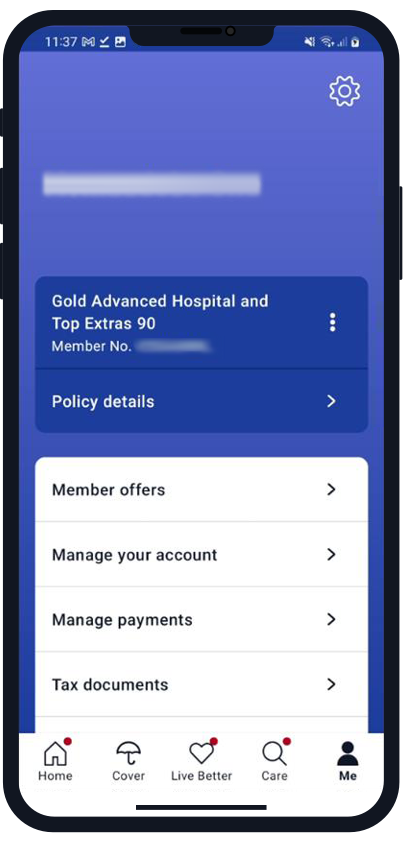

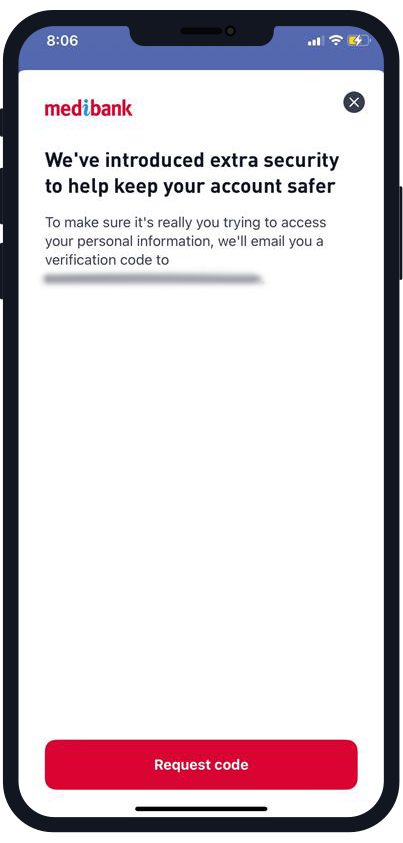

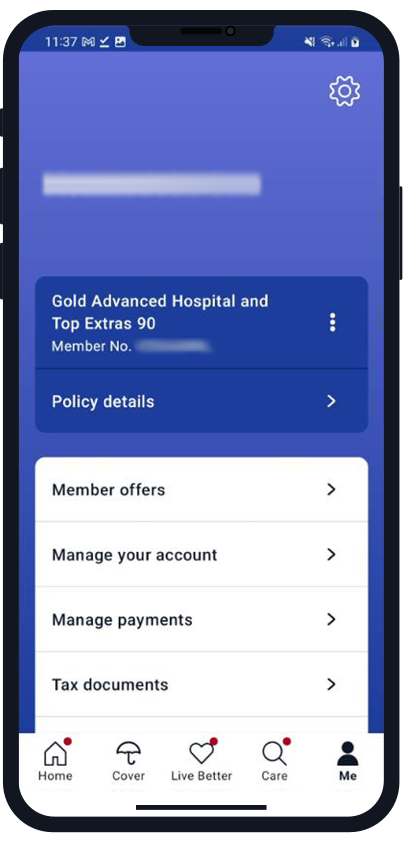

How to view and download your statement on the app

What is your Australian Government Rebate and how to update it

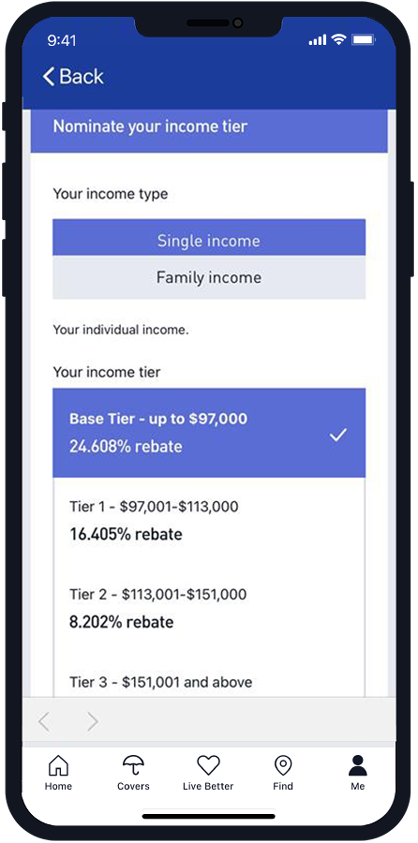

The government may offer a rebate on health cover premiums known as the Australian Government Rebate (AGR).

Read more about the AGR and how it's calculated.

If you want to check you’re on the correct AGR income tier or change your income tier, you can do this on My Medibank. See how to instructions below.

How to view or change your Australian Government Rebate Income tier on the web

How to view or change your Australian Government Rebate Income tier on the app

Overseas health cover

Do you need a tax statement for your Overseas Health Cover?

If you're on Overseas Student Health Cover, Overseas Visitor Health Cover, or Overseas Worker Health Cover, you generally won’t need a tax statement from us at tax time. That’s because these covers are considered non-Complying Health Insurance Policies (non-CHIP), which means:

- You can’t claim the Australian Government Rebate (AGR) on these policies, and

- These policies don’t provide an exemption from the Medicare Levy Surcharge

Important Exception:

We will only issue a tax statement to Overseas Workers with Medicare entitlements who also hold Basic Reciprocal Exemption Cover. In this case, your tax statement will automatically be sent to the Australian Tax Office and available in My Medibank by July 15.

Not sure if you need to pay the Medicare Levy Surcharge? (MLS)

Medibank can’t determine your MLS liability, so we recommend contacting Medicare directly on 1300 300 271 for advice specific to your situation.

If you find that you're liable for the surcharge, please get in touch with us. We may be able to offer cover options that can help you avoid the Medicare Levy Surcharge in the future.

We’re here to help, even during busy times.

Due to the premium review period, we may be experiencing longer-than-usual call wait times. We appreciate your patience as we work to assist everyone as quickly as possible. If you prefer not to wait, feel free to get in touch another way.

Message us

Monday to Friday:

8am – 11pm AEST/AEDT

Saturday to Sunday:

9am – 9pm AEST/AEDT

Have us call you

Monday to Friday:

8:30am - 6pm (Local State Time)

Saturday:

10am - 2pm (Local State Time)

Closed on Sunday, all National and Local State Public Holidays

Visit us in store

Want to know more?

If there are any other questions you’d like answered, go to medibank.com.au/contact-us.