Get more benefits with Extras Cover

With Extras cover, you receive a range of benefits that reduce your out of pocket expenses when you claim on non-hospital services that aren’t normally covered by Medicare – like dental optical, physio and so much more. The types of services you will receive benefits on will depend on the extras cover you select, the waiting periods and your annual or lifetime limits.

Here's how Medibank's current range of extras covers could benefit you:

100% back on dental check-ups twice a year

Here's something to smile about - all Medibank members with eligible extras cover get 100% back on up to two dental check-ups every year, including x-rays, at any Members' Choice Advantage dentist.1

100% back on optical items

Everyone deserves to see the world clearly. That’s why when you join Medibank extras you get 100% back on optical items at all recognised providers up to annual limits.2

One of Australia's largest provider networks

Our Members’ Choice network generally offer capped fees or discounts to help reduce out-of-pocket expenses across dental, optical, physiotherapy and more.3 With over 3700 provider locations, our Members' Choice extras network is one of the largest in Australia.

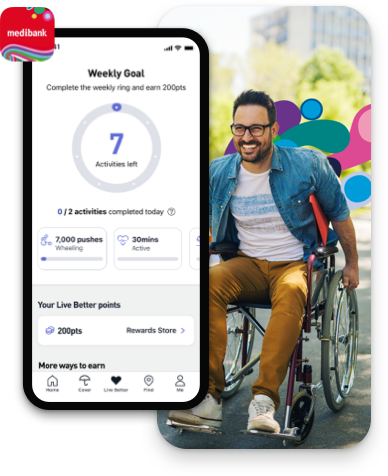

Live Better, get rewarded

You could earn up to $400 worth of rewards every year.#

With Live Better Rewards, you can earn points by tracking healthy actions. And if you're an eligible Medibank member with hospital or extras, these points can go towards rewards from select partners such as adidas and THE ICONIC, as well as select Apple products, extras limit increases or a $200 premium payment.4

Ready to get a quote?

Curly questions with straight answers...

Things you should know

+ For former members who held an eligible Medibank hospital or extras cover more than 30 days ago (30 day requirement does not apply to dependants coming off their parent’s cover. Must join, start and maintain eligible extras cover from 10 December 2024. Must quote promo code WELCOMEBACK6 and set up direct debit when joining. Excludes Healthy Living Extras, combined Hospital & Extras covers, Corporate covers, Hospital Cover, Accident Cover, Ambulance Cover, Overseas Visitors Health Insurance, Overseas Students Health Cover (OSHC), Overseas Workers Health cover, ahm covers and other selected covers. Not available to Medibank employees. Not available with any other offer. We reserve the right to amend these offer terms and conditions at any time without notice.

6 weeks free terms: Must maintain direct debit and hold eligible cover for 42 consecutive days (6 weeks) from the policy start date to get next 6 weeks free. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period.

2&6 month waits waived on eligible extras terms: 2&6 month waiting periods on eligible extras waived. Other waiting periods apply (including 12 months on some dental services). If you're switching from another fund and you've used any of your current limits (at that fund), that will count towards your annual limits with us. If you’ve reached your limits at your previous fund, you may not be able to claim straight away.

Live Better points terms: Must maintain direct debit and hold eligible product for 42 consecutive days from the policy start date to receive Live Better points. The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank App. Policyholder will need to have registered a My Medibank account, sign up to Live Better via the My Medibank App and track any Live Better activity within 42 consecutive days from the policy start date. Must be 16 years or over to register for Medibank’s Live Better. Live Better points could take up to 10 weeks from the policy start date to be loaded to the policyholder’s Live Better account. Singles, single parents, families and couples will receive 5,000 Live Better points.

Live Better rewards terms: Must be a Medibank member with eligible hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better via the ‘My Medibank’ app to redeem rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/

1 Eligible members on Medibank extras (excluding Healthy Living Extras and Gold Ultra Health) can claim a maximum of two 100% back dental check-ups per member, per year at a Members’ Choice Advantage provider (including bitewing x-rays where clinically required). For members on eligible extras, the first two check-ups do not count towards your annual limit. Members with Healthy Living Extras can get 100% back on one dental check-up each year at a Members’ Choice Advantage provider (including up to two bitewing x-rays, where clinically required) or at a Members’ Choice provider (excluding x-rays). Members with Gold Ultra Health can get 100% back on up to three dental check-ups at a Members’ Choice or Members’ Choice Advantage provider. Members’ Choice and Members’ Choice Advantage providers are not available in all areas. Two month waiting period applies. Some products may have other dental benefits, check your cover summary for details.

2 Excludes Healthy Living Extras and select products that are no longer available for sale (for more information check your cover summary or check this page). 6 month waiting period applies. Includes prescription glasses and select contact lenses. Some glasses lens coatings and contact lenses are excluded. To find which specific items are included or excluded, call us on 132 331.

3 Members' Choice not available in all areas.

# Live Better rewards members could earn up to 40,000 Live Better rewards points each calendar year for successfully completing select Live Better rewards points-earning activities. These activities include, but are not limited to, health and wellbeing challenges, the Weekly Goal, onboarding actions, partner activity earn and the daily auto-tracking bonus. This does not include points earned by shopping with Live Better rewards partners or visiting Members' Choice Advantage providers. 40,000 Live Better points could be redeemed for up to $400 worth of rewards from the Live Better rewards store

Medibank Live Better Challenges & Goals Earning Policy: The participant of a Medibank Live Better Challenge or Goal may not receive Live Better points or may have their already credited Live Better points reversed in accordance with the Medibank Live Better terms and conditions. To earn Live Better points, the participant needs to complete 100% of the eligible Challenge according to the instructions. The number of Live Better points available for Medibank Live Better Challenges and Goals is subject to change without prior notice. To the extent of any inconsistency between this Policy and the Medibank Live Better rewards terms and conditions, the terms and conditions will take precedence.

4 Must be 18 years or over and have a valid Australian residential address to register for Medibank Live Better. Must be a Medibank member with hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better with ‘My Medibank’ or have linked their MyMedibank account with their Live Better account to redeem rewards. Excludes Overseas Visitor health cover, Working Visa health cover, Overseas Student Health Cover (OSHC), Ambulance only cover, ahm covers and other selected covers. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. See full Medibank Live Better terms.

^ You need to join Medibank within 2 months of leaving your old fund, or waiting periods apply again. Also, benefits that have been paid under your previous cover will be taken into account in determining the extras benefits payable under your Medibank cover.