Introduction

On this page

Medibank provides private health insurance through our Medibank and ahm brands. During the year we supported customers through more than 1.3 million hospital admissions, 500,000 surgical procedures and 23.8 million extras services.

We also delivered a range of health services across Australia including telehealth, in home care and care management, and distributed travel, life and pet insurance.

Milestones

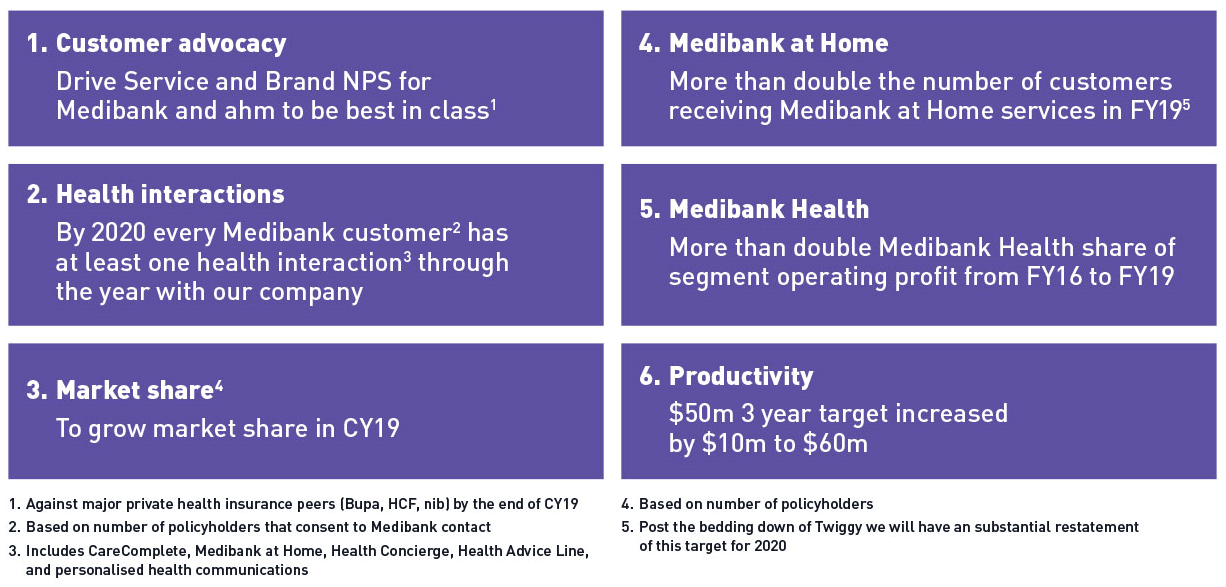

Our focus for the year ahead is on delivering for our customers, differentiating our Medibank offering and continuing our transformation into a health services company.

We have set a broader Customer Advocacy metric and added new targets for customer check-ins to ensure we’re matching customers to the right level of cover. We are also looking to double the number of customers who are receiving Medibank at Home services, and aiming to ensure every Medibank customer will have at least one annual health interaction with us by 2020.

Milestone summary

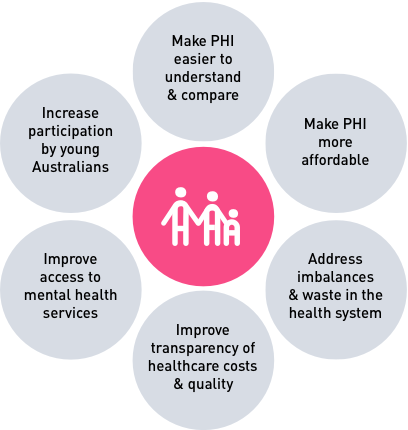

Reform

Medibank has made significant progress in delivering our customers a better experience, better service, better products and more value. We welcomed the reforms announced by the Government in October 2017 and continued to work with the health sector during the year to support the sustainability of Australia’s health system. More reform is essential in order to drive the sustainability of Australia’s health system as the community continues to age.

Our reform focus

See Improve healthcare value for more information about reform in 2018

Our average premium increase of 3.88% across all Medibank and ahm health insurance products from 1 April 2018 was our lowest in 17 years. It was also below the industry average for a second year in a row. This was a result of passing on the $50 million savings from prostheses reform as well as the savings expected from our ongoing efforts to reduce Medibank’s costs.

“An increase is still an increase, but I want our customers to know that improving affordability remains a key focus and we need to keep working even harder to deliver on this promise for them”

CEO Craig Drummond, 25 January 2018

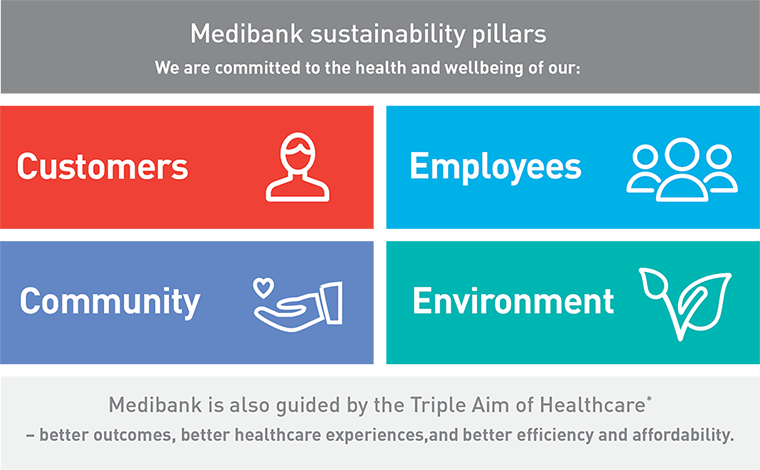

Sustainability

Medibank’s approach to sustainability reflects our Better Health for Better Lives purpose. We completed our first materiality assessment in 2017 to identify the Environmental, Social and Governance (ESG) issues of value and importance to a broad range of our stakeholders. We group these issues under four overarching pillars.

Medibank sustainability pillars

To reflect the importance of sustainability to our business and stakeholders, we formally report on these pillars for the first time in our 2018 Annual Report

To support our sustainability focus, Medibank participated in the Carbon Disclosure Project and Dow Jones Sustainability Index (finalised in September 2018) during the year.

We also had our community investment independently verified by the London Benchmarking Group. Medibank also takes into account the United Nations Sustainable Development Goals in our sustainability activities.

Responsible investment

We are committed to ensuring that our investment portfolio is sustainable and we updated our Responsible Investment Policy to set out Medibank’s approach to considering ESG factors in our investment decisions.