We have your family's back in an emergency

As one of Australia’s leading health insurers1 with over 45 years of experience, we understand what is important to families. Our hospital covers come with a suite of benefits that support your family when you need it most, at no extra cost.

24/7 Medibank Health Support

Being a parent is a 24/7 job. That's why members with health insurance can speak to a registered nurse or mental health professional at no extra cost.² Chat over the phone or online any time of the day or night.

Unlimited Emergency Ambulance

For ambulance attendance or transportation to a Hospital or other approved facility where immediate medical attention is required and your condition is such that you couldn't be transported any other way. 1 day waiting period applies.^

No Hospital Excess for kids

One less worry with no Hospital excess for kids on all family covers.3

Accident Cover Boost

With our Accident Cover Boost, you could get Gold level Hospital benefits if you have an Accident and hold eligible Hospital cover, regardless of your level of cover.4

Want more options during an emergency?

You're not just a parent. You're a 24-hour kid-protecting machine. And so are we. That's why with our new Private Emergency Department Benefit> available on Silver Plus Support and above Hospital covers, we’ll pay towards the admission fee charged for attending an Emergency Department at a Private Hospital. The benefit has an annual limit, per membership of $300, $400 or $500 depending on the product. If you attend a Private Emergency Department there may be other fees applicable.

Choosing the right Hospital cover

Bronze Hospital Cover

Looking for outstanding value cover? Our Bronze Hospital cover is a cost-effective option that includes a range of services to help you feel protected when it comes to your health.

Silver Hospital Cover

Entry to Silver includes additional Hospital services such as heart & vascular, lung & chest and more. Get added support from a Private Emergency Department Benefit> available on Silver Plus Support and Silver Plus Secure Hospital covers.

Gold Hospital Cover

If you're thinking about growing your family, our top-level Hospital cover includes pregnancy and birth related services as well as assisted reproductive services.

The amount you pay before Medibank contributes to your hospital costs.

Waiting periods and annual limits may apply.

We can help you choose a cover that best suits you and your family.

Getting health insurance could mean hospital cover, extras cover or a combination of the two. Let us help you find the most suitable cover for you and your family's needs.

Hospital & Extras offer - Want up to 12 weeks free plus up to $500 in gift cards?

Join and maintain eligible Bronze hospital and extras cover or above and you could get up to 12 weeks free plus 50,000 Live Better points (couples and families) or 25,000 Live Better points (singles and single parents) to redeem on rewards like gift cards. We'll also waive 2&6 month waiting periods on extras. Use promo code: 12WEEKSPLUS. Offer ends 15 July 2025. New members only.€

Get a quote Find out more

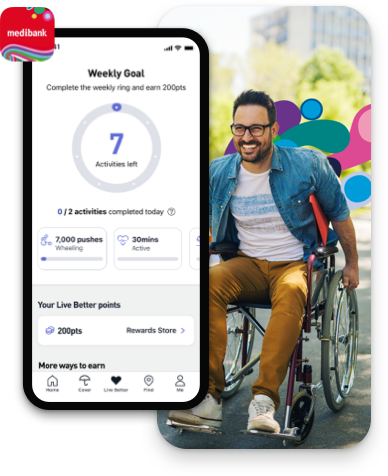

Be rewarded for healthy living

You could earn up to $400 worth of rewards every year.#

With Live Better Rewards, you can earn points by tracking healthy actions. And if you're an eligible Medibank member with hospital or extras, these points can go towards rewards from select partners such as adidas or THE ICONIC, as well as select Apple products, extras limit increases or a $200 premium payment.##

Want to keep your kids on a family cover?

We've increased the maximum age for Dependants from 24 to 30. This means eligible Dependants could stay on your eligible residential family policy until they turn 31, provided they are not married or living in a de facto relationship. For the first Dependant aged 21 and over there is an additional loading fee, unless they are studying full time at an Australian Educational Institution.5

If your Dependant is between the ages of 18-29, don't forget to consider the ongoing benefits of the Young Adult Discount which is available to them when they take out their own eligible Hospital cover.6

Every family is different. Get in touch to see what is best for you and your Dependants.

Things you should know:

1 Based on the number of policies set out in APRA’s Operations of Private Health Insurers Annual Report 2021 for Medibank Private Limited

2 Some referred services may involve out of pocket costs and waiting periods may apply.

3 Other out–of–pocket expenses may apply.

4 For Accidents that occur in Australia after your cover starts. Must seek medical treatment within 7 days, and receive hospital treatment within 12 months, of the Accident occurring. Excludes Private Emergency Department Benefit, hospital bonus, claims covered by third parties and our Private Room Promise. Out of pockets may apply.

5 Eligibility requirements apply for Dependants. Only available on eligible policies. Additional costs for the first Adult Dependant. Eligible Student Dependants may be added to most Overseas Visitors Health Cover and all Overseas Workers Health Cover products. Adult Dependants cannot be added to any overseas health covers.

6 To be eligible for the Young Adult Discount, a Young Adult must have their own residential hospital policy or a residential hospital policy with their partner. They cannot be a dependent on their parents' policy. If they are on their own couple or family policy, the discount is calculated by taking an average of the discount applied to the adults on the hospital cover. So, if one person has a 10% discount and their partner has no discount, or 0%, the discount applied is 5% overall.

>Two month waiting period applies. We'll pay a benefit up to an annual limit per membership towards any admission fee ("facility fee") charged by the Private Hospital for patients attending a Private Accident and Emergency Department. The fee amount varies by Private Hospital and does not include medical and other charges (such as charges for diagnostic imaging or pathology), so out of pocket expenses may still apply. Only available at Private Hospitals with an Accident and Emergency Department. Members will need to submit a claim to receive the benefit and may have to pay upfront.

^ For ambulance attendance or transportation to a hospital where immediate medical attention is required and your condition is such that you couldn't be transported any other way. TAS and QLD have State schemes that provide ambulance services for residents of those States.

# Medibank Live Better Challenges & Goals Earning Policy: The participant of a Medibank Live Better Challenge or Goal may not receive Live Better points or may have their already credited Live Better points reversed in accordance with the Medibank Live Better terms and conditions. To earn Live Better points, the participant needs to properly complete 100% of the eligible Challenge according to the instructions. The number of Live Better points available for Medibank Live Better Challenges and Goals is subject to change without prior notice. The maximum number of Live Better points that each Medibank Live Better member can earn from successfully completing health and wellbeing Challenges, Goals or any Onboarding action in a calendar year is 40,000 Live Better points. To the extent of any inconsistency between this Policy and the Medibank Live Better terms and conditions, the terms and conditions will take precedence.

## Must be 16 years or over to register for Medibank Live Better rewards. Some program partners and earning activities require a person to be at least 18 years of age to be eligible to earn and/or redeem a reward. Must be a Medibank member with hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better rewards in the My Medibank app to earn Live Better points for eligible purchases and redeem rewards. Excludes Overseas Student Health Cover (OSHC), Ambulance only cover, ahm covers and other selected covers. Live Better Management Pty Ltd, ACN 003 457 289 has entered into commercial arrangements with Medibank Live Better program partners and may receive commissions. Additional terms and conditions may apply to points earning activities and rewards. Points earning activities and rewards are subject to change and may be subject to availability. Wherever possible, we will give you notice of these changes. See full Medibank Live Better rewards terms.

€ For new members on new memberships who join and start eligible combined Bronze hospital and extras cover or above from 14 May – 15 July 2025, AEST and who have not held Medibank health cover in previous 60 days (unless they are dependents coming off their parent’s cover). Must quote promo code 12WEEKSPLUS and set up direct debit when joining. Must have Australian residence. Excludes Basic cover, Corporate covers, Hospital only cover, Extras only cover, Accident Cover, Overseas Visitors Health Cover, Overseas Workers Health Cover, Overseas Students Health Cover (OSHC), Ambulance Cover, ahm covers, and other selected covers. Not available to Medibank employees. Not available with any other offer. Medibank reserves the right to amend these Terms and Conditions from time to time.

Weeks free terms: Must remain up-to-date with premium payments and hold eligible cover for 42 consecutive days from the policy start date to get initial 6 weeks free, and for 15 consecutive months to receive subsequent 6 weeks free. The initial 6 weeks free will be applied at the next billing cycle after you have held eligible cover for 42 consecutive days. The subsequent 6 weeks free will be applied at the next billing cycle after you have held eligible cover for 15 months. The 6 weeks free will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Discounted amount to reflect level of eligible cover at time of discount.

2&6 month waits waived on extras terms: 2&6 month waiting periods on extras waived. Other waiting periods apply (including 12 months on some dental services). If you're switching from another fund and you’ve used any of your current limits (at that fund), that will count towards your annual limits with us. If you've reached your limits at your previous fund you may not be able to claim straight away on extras.

Live Better points terms: Must maintain direct debit and hold eligible product for 42 consecutive days from the policy start date to receive Live Better points. The points will not be issued if you change to an ineligible cover, terminate your cover or suspend your cover during this period. Policyholder will require access to a smartphone and will need to download the My Medibank App. Policyholder will need to have registered a My Medibank account, sign up to Live Better via the My Medibank App and track any Live Better activity within 42 consecutive days from the policy start date. Policyholder must also maintain direct debit and continue to hold an eligible product for 42 consecutive days from the policy start date to receive the Live Better Points. Must be 16 years or over to register for Live Better. Live Better rewards points could take up to 8 weeks from the policy start date to be loaded to the policyholder’s Live Better account. Singles and single parents will receive 25,000 Live Better rewards points, and families and couples will receive 50,000 Live Better rewards points.

Live Better Rewards terms: Must be a Medibank member with eligible hospital cover, extras cover, or hospital and extras cover, be up-to-date with premium payments and have signed up to Medibank Live Better via the ‘My Medibank’ app to redeem rewards. Additional terms and conditions may apply to the redemption of a reward depending on the type of reward chosen. Read full Medibank Live Better terms here: https://www.medibank.com.au/livebetter/rewards/terms/